Online Title Loans in Lake Elsinore, CA

Avoid all the hassles of getting online title loans in Lake Elsinore, CA! Use our new great service to apply for fast title loans and get a free estimate. Send in your request from home, your work or anywhere you are with internet. Anytime and from any location!

5 Star Car Title Loans is now offering a more convenient way to get your money with online title loans in Lake Elsinore, CA. Don’t delay – send in your request for an instant cash loan now and get a fast reply!

Car Title Loans Online Application Process

Pre-Qualify – Fill out our quick online form and instantly see if you pre-qualify

Additional Info – Use our mobile app to upload vehicle photos, driver’s license and car title

Loan Offer & Terms – One of our loan specialists will contact you with your loan offer

Online Car Title Loans - How it Works:

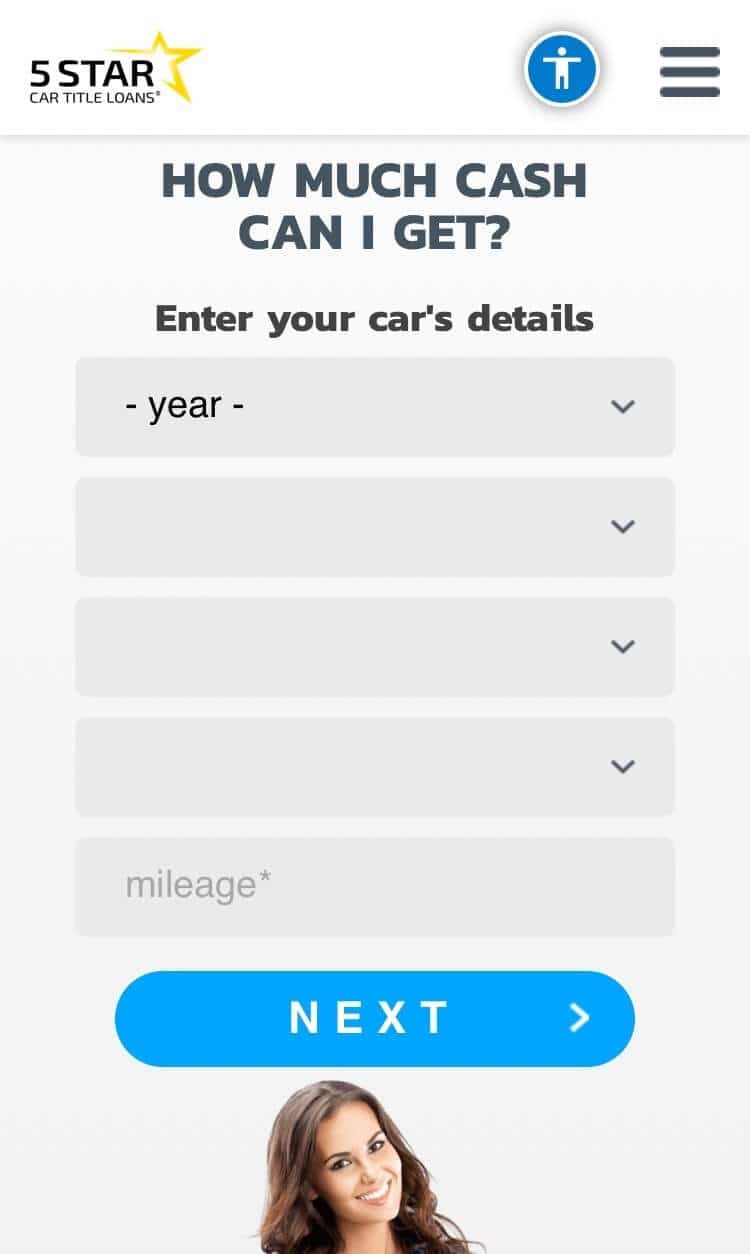

A. Submit the following info to see how much cash can you get:

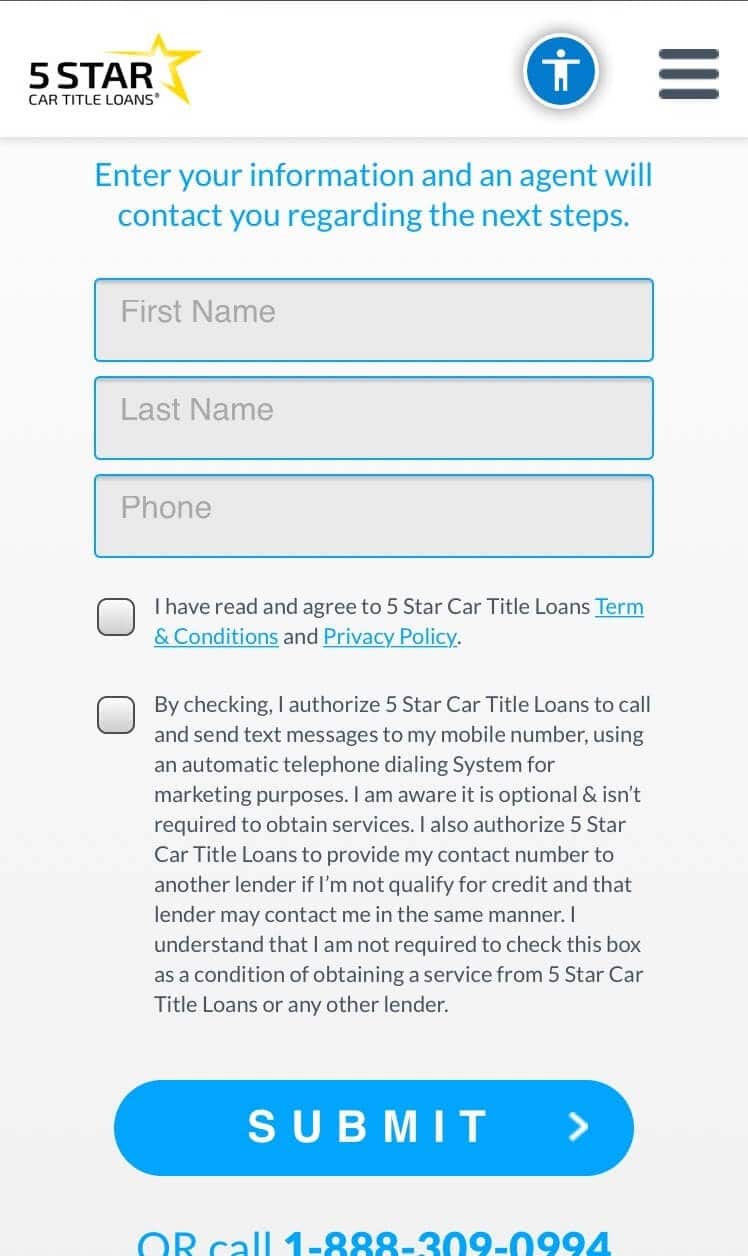

- Your name

- Phone number

- Vehicle information

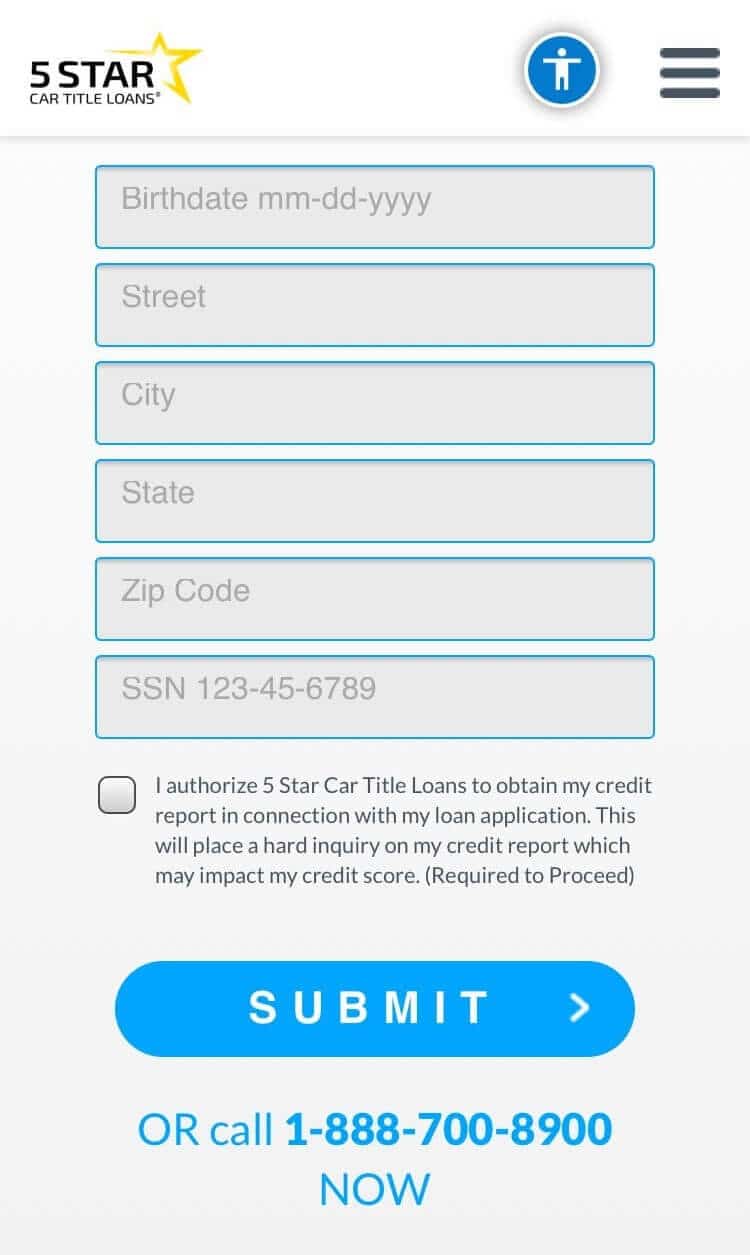

- Address

- Date of birth

- Social Security Number

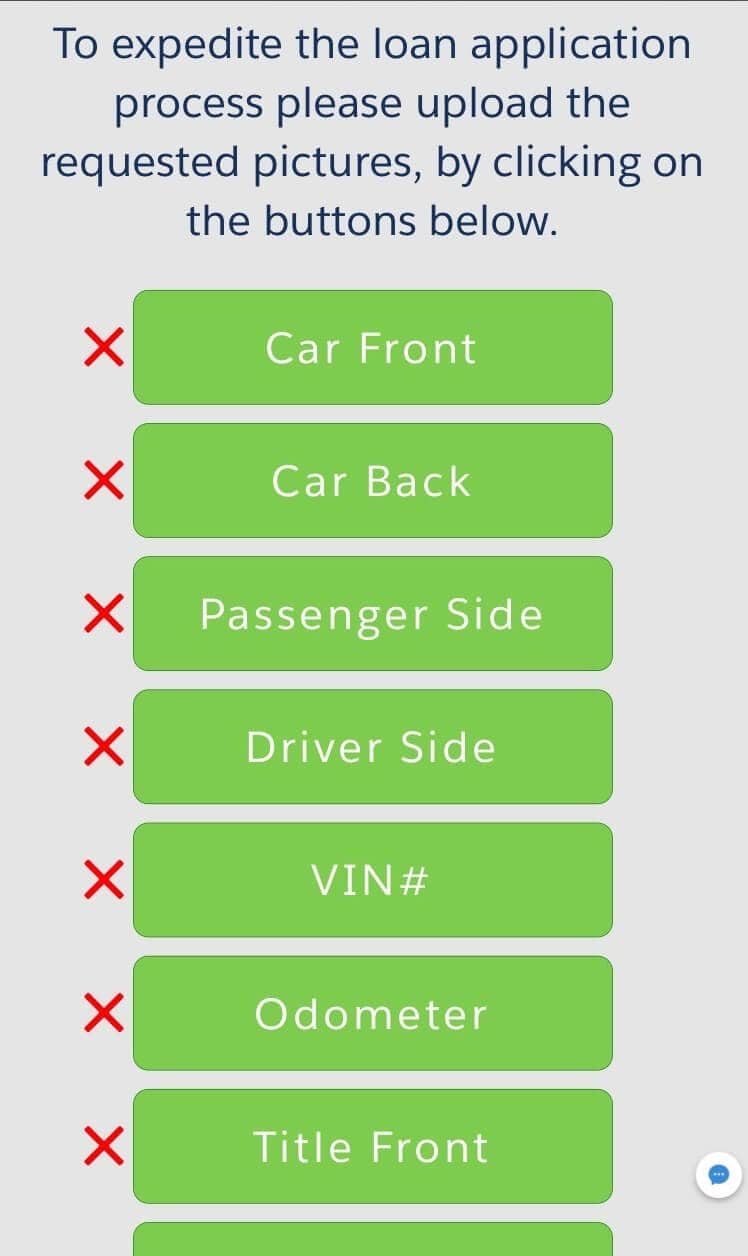

B. Once pre-approved, our user-friendly mobile app will allow you to upload:

- Photos of your vehicle

- Driver license

- Car title

C. Get an online title loans offer and terms

Upon receipt of the above described items, one of our loan specialists will be contacting you with your loan offer and terms.

D. Complete the loan process and get your money

To complete the title loan process, all* you’d need to do is stop by any FedEx store and ship the title to us. Our loan agent will print out a FedEx label for your convenience.

Once the title was dropped, we will simply direct deposit the funds into your debit or prepaid card.

*In some case you will be required to stop by one of our GPS Centers so we can install (free of charge) a tracking device onto your vehicle.

Online Title Loans in 4 Easy Steps

Enter Your Car's Details:

Your Personal Information:

Address, Date of Birth and SSN:

Upload Photos of Your Vehicle:

Getting an Online Title Loan in Lake Elsinore, CA Streamlines the Process:

- Compare rates and pre-qualify online

- Apply using our website instead of visiting our branch

- Get a fast approval decision

- Get a free estimate – compare a variety of offers!

- Get a direct deposit of funds* to your debit card or a prepaid card

*You can also walk into any MoneyGram location inside a Walmart Center close to you and pick up Cash at the MoneyGram kiosk

Services Offered

Car Title Loans

Motorcycle Title Loans

Track Title Loans

RV Title Loans

Boat Title Loans

Products Details

Any Credit History Accepted

Title Loans Ranging From 25% to 120% of Car’s Value

No Extra Fees or Penalties for Prepayment

Annual Percentage Rate (APR) From 60% Up to 175%

Keep Driving Your Vehicle!

Best Reasons for Online Car Title Loans in Lake Elsinore

Getting online car title loans in Lake Elsinore can vary between different loan companies, but they all offer similar benefits? Compare the advantages of 5 Star Car Title Loans to traditional loans to see why they are so popular!

Pros of Vehicle Title Loans

1. Car title loans completely online: Use the option of car title loans completely online to get the fastest turn-around on your fast cash. The whole process can be done online at anytime.

2. Consolidate your debt: Consider applying for fast title loans to consolidate all of your debt into one payment. Use the money to pay your current debts and be left with only one payment each month instead of multiple payments.

3. All credit types: No matter what your credit background is, you can still be considered for car title loans for bad credit. At 5 Star Car Title Loans, we use a variety of credit criteria to determine your eligibility. Besides the value of your auto and your monthly income, we look at the whole picture. That can mean your educational background, your occupation or other factors.

4. Easy online comparisons: You can easily compare interest rates between several lenders. You only need to send in your online pre-qualification form to be able to get quotes from a few companies. Then you can decide which offer is best for you.

5. Estimates with no obligation: There is no need to pay before you get pre-approval for the best title loans. Send in your online application and get an offer. Then make your decision which offer to accept.

Take a Look at Our Online Services

A. We keep all of your information completely confidential. We do not share your details with anyone.

B. Fast and simple online applications

C. You can keep your car to drive as needed

D. Many types of payment options

E. Customer service is open 6 days per week

F. Many locations throughout California to choose from

G. 3 options for fast funding

Choose from these Loan Types

When you want to apply for auto title loans online, you can choose between a variety of loan types, depending on your car.

These are the main loan types:

A. Auto title loans

B. Motorcycle loans

C. Pawn loans

D. ATV title loans

E. Personal loans

F. Unsecured loans

G. Boat title loans

Do you own a different type of vehicle with a title? Contact our office to see how we can use your vehicle as collateral for vehicle title loans.

How Does the Process for Title Loans in Lake Elsinore Work?

Following are the basic steps for getting title loans from start to finish:

- Fill out your application for title loans and send it online or call our office for help.

- If your application is pre-approved, the lender will carry out an inspection of your car.

- You will get a decision regarding approval according to your ability to repay a loan and, among other factors, your vehicle’s value.

- When your online application is approved and accepted, the lender will put a lien on your vehicle.

- Within a short time you can get your fast cash and still keep your car.

- Make the first payment 30 days following loan approval. Continue paying monthly.

- Finish paying all the loan back and your title is returned.

How to Return the Money on Car Title Loans in Lake Elsinore

If you’re like most other borrowers, you will be finished paying back your car title loan in Lake Elsinore within approximately eight months. The first payment you’ll make will be 30 days after you sign the contract. From there on, you can send one payment each month.

Here are the Payment Options:

Payments online: This can be the easiest option, because you don’t have to go anywhere or do anything. You can easily send in your payment on time with your mobile phone. You’ll need an account for this option, but our customer service agents can help you get that set up.

Pay by phone: For this option, you will need to have a debit/credit card. Just call our office and we’ll help you submit your payment by phone.

Cash payments: If cash is easier for you, then go into the 7 Eleven store most convenient for you. They are set up to take cash payments on car title loans.

When you have made all your payments, the process to remove the lender’s name from your title will begin. When the title comes back to you, it will be clean and clear of any lien

Frequently Asked Questions

1. I am nearly finished paying off my car. Can I get a title loan now, before I have finished?

Depending on the value of your car and the ability for you to make loan payments, you might be able to get a title loan before you finish paying the loan. We will evaluate your situation and if possible, we’ll loan you enough money to pay off the finance company, bank, dealership or credit union. After finishing the payments, you should have money left over from your instant cash advance online to use for anything you need.

2. What is the amount I can get with car title loans for bad credit?

There are factors we take into account before approving your request for car title loans for bad credit. You don’t necessarily need to have good credit to get car title loans. However, approval can depend on several things, such as:

A. The specific lender you apply with

B. If your income will enable you to pay back the loan

C. California state laws that apply to car title loans

D. Your vehicle’s condition

E. Your car’s value

After you find out how much you can get, we recommend only taking as much as you need and no more. Call us to find out more information.

3. Are there hidden or unexpected fees added to title loans?

No, there aren’t hidden charges. Everything you need to pay will be on the contract you sign.