Loans for Any Purpose

Who We Are

At 5 Star Car Title Loans®, we’re here to help people access emergency funds when life brings unexpected challenges.

We provide fast, loans secured by your car title with no hidden surprises and no long waits. Loans are made pursuant to the Department of Financial Protection and Innovation (DFPI), Lender License No. 603J988.

Our mission is to make borrowing safe, simple, and quick while giving every customer the clarity and confidence to make informed financial decisions.

Lending. Supporting. Inspiring!

Personal Online Loans for Any Purpose

Our Services

We specialize in vehicle title-secured loans, installment loans, and same day loans.

Unlike traditional lending that focuses mainly on credit history, our loans are based on your vehicle’s value and your ability to repay.

No prepayment penalties – repay anytime

All applicants welcome, even with bad credit

Keep driving your vehicle while making payments

Use funds for emergencies, bills, or personal needs

Loan amounts from $100 to $50,000

Terms set by state law, usually 12–36 months

APR varies by state, up to 300%

Our Story

The Beginning

We started in 2012 with one goal: to give people a fair way to access money in emergencies. By keeping the process simple and transparent, we quickly expanded across major California cities including Los Angeles, San Francisco, Sacramento, and San Diego.

2012 – Long Beach, CA

The first location opened in Long Beach, CA, giving residents quick access to cash and marking the start of 5 Star Car Title Loans®.

2012 – First Branch Opens

2022 – Expanding Nationwide

In 2022, we extended our services across the U.S., offering title loans and personal loan options for people with less-than-perfect credit, supported by trusted lending partners nationwide.

2025 and Beyond

We now provide loan opportunities 24/7 and have helped more than 255,000 people cover urgent expenses.

Looking ahead, we will continue investing in new technologies and customer-focused innovations to make borrowing even faster, safer, and more convenient.

Our Team

Leadership

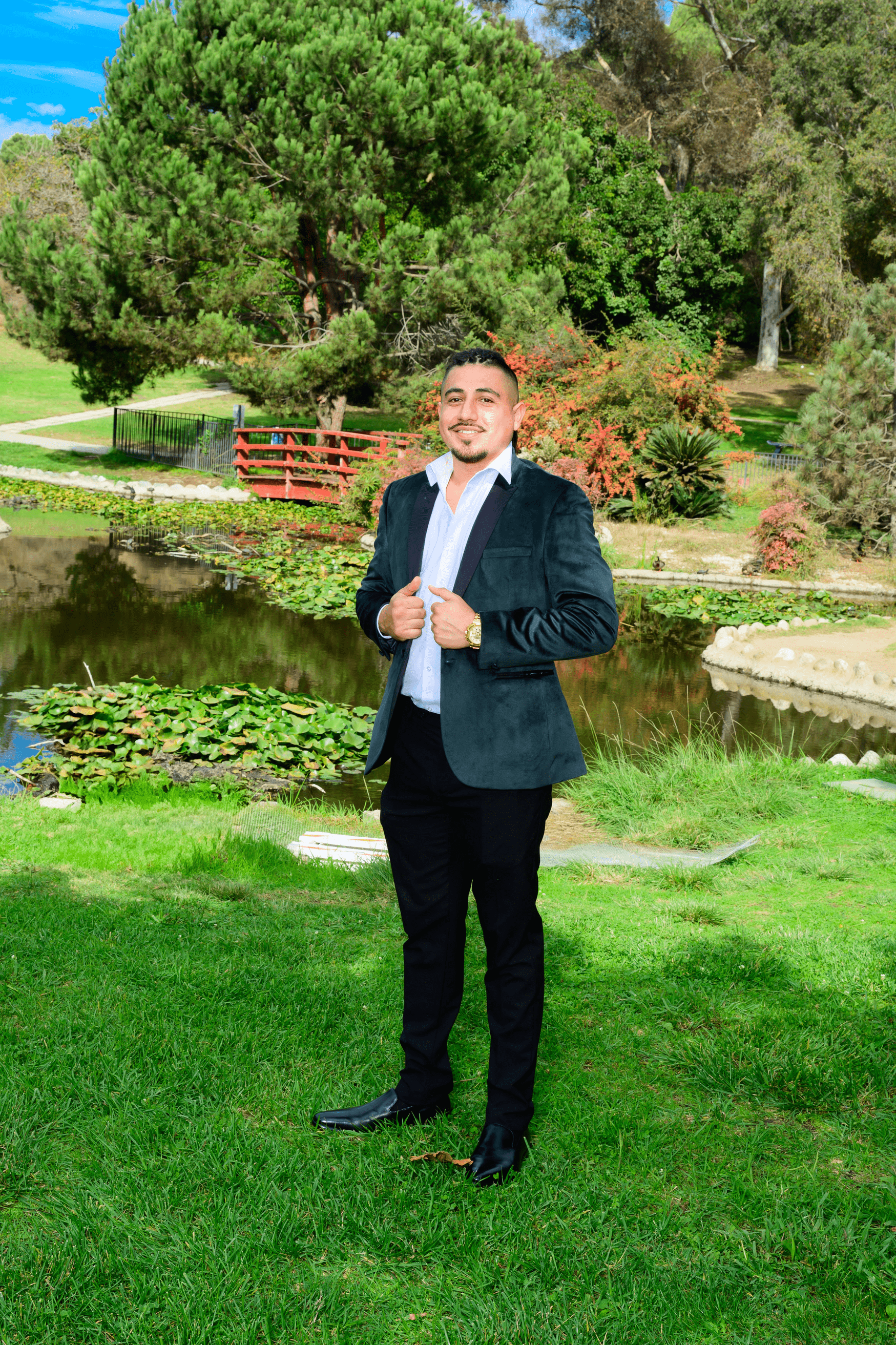

Bryan Solis – Head of Sales

With over a decade of experience in auto finance, personal loans, and car title loans, Bryan brings expertise across both prime and subprime markets.

Holding a degree in Business Administration, he has guided start-ups and established organizations to growth and long-term success. At 5 Star Car Title Loans®, Bryan leads sales operations with a strong focus on customer relationships, transparency, and compliance.

Our Team

Supporting Bryan is a dedicated group of experienced professionals in compliance, underwriting, customer care, and loan servicing.

Our international support team ensures that we are available at all times, working together toward one shared goal: providing clear, reliable, and customer-first lending solutions.

Our Impact

Our numbers speak for themselves:

13+ Years

Since 2012

24/7

Always here

255,000+

People helped

Compliance

Licensed & regulated

What Drives Us

Our Values

Transparency – Clear terms and no hidden fees. We follow the Truth in Lending Act (TILA) closely, ensuring contracts are transparent and easy to understand.

Efficiency – Fast approvals and funding when people face urgent needs, always in compliance with TILA and state laws.

Fairness – Every customer matters, regardless of credit history. We follow protections under ECOA, FCRA, and FDCPA, treating borrowers fairly and with dignity.

Responsibility – We approve loans when income shows the borrower can afford the payments. The Ability-to-Repay (ATR) rule was created for mortgages, but we apply the same principle as a common-sense protection for our customers.

Protection – Customer information is safeguarded with 256-bit SSL encryption and TLS protocols, the same protections trusted across the financial industry.

Privacy & Security

Certified Secure

Our site, 5starloans.com, is Certified Secure. TrustedSite actively monitors it for threats like malware, phishing, or malicious links.

Privacy

We give customers control of their personal data. Under the California Consumer Privacy Act (CCPA), you have the right to know what we collect, request deletion, or opt out of sharing. Beyond California, we follow nationwide best practices to keep your information safe.

Why Choose Us

Trusted Reputation – Serving customers since 2012 with over 255,000 loans funded

Fast & Flexible – Loan approvals can be completed quickly, with no prepayment penalties

Compliance First – Licensed under DFPI and aligned with federal consumer protection laws

Customer Support – A dedicated team available to guide you every step of the way