Survey Reveals: The Most Hated Taxes in the U.S. [2025]

Every year, tax season sparks the same conversations: frustration, confusion, and a few jokes about moving off-grid.

But our survey of over 3,000 respondents goes beyond the usual grumbling. It doesn’t just ask how much people pay; it asks how they feel about it.

And those feelings paint a picture of a nation that’s not simply angry about money, but about fairness, priorities, and how much control they actually have over either.

Key Findings

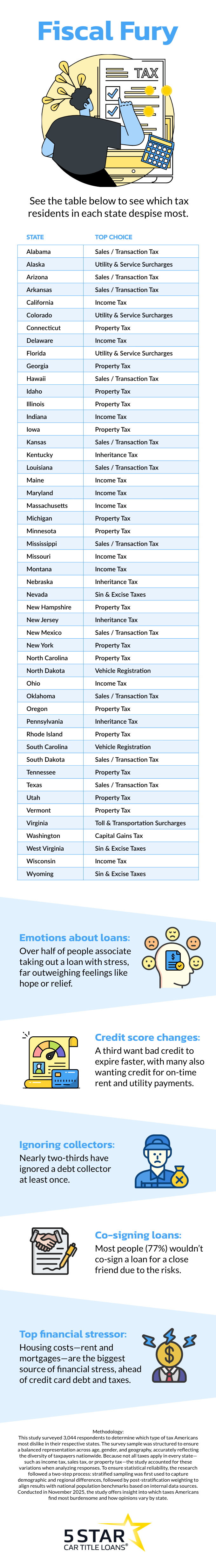

Property Tax is the Most Despised Nationally

In more than half the states, property tax was named the most-hated levy. For homeowners, it’s the bill that never really ends, a yearly reminder that you never quite “own” your home outright.

Rising house prices have turned what used to be a stable, predictable tax into one that grows faster than paychecks.

Sales Taxes Hit Where It Hurts Most

Sales and transaction taxes ranked high in southern and midwestern states, especially where groceries are taxed at the same rate as luxury goods. It’s a tax that’s transparent but relentless, always visible, never forgotten.

Income Taxes: The Familiar Frustration

Income tax ranked as the top complaint in several coastal states. The irritation goes beyond the number on the form: it’s about the mental load of calculating, tracking, and filing.

Many Americans feel their contributions don’t match the services they receive, fueling the sense that they’re funding inefficiency, not improvement.

In higher-tax states, the sentiment borders on betrayal: the more successful you become, the higher the price of success seems to be.

Inheritance and “Sin” Taxes Stir Strong Feelings

Inheritance taxes still exist in just a handful of states, but they provoke outsize anger. People see them as a penalty for dying responsibly.

Sin and excise taxes, meanwhile, spark a different debate, not over the amount, but the moral tone. For many, they feel less like fiscal policy and more like gentle scolding from the state: a reminder that indulgence comes with a bill attached.

Hidden Taxes are Particularly Despised

Utility surcharges, tolls, and licensing fees didn’t top the national list, but they generated surprising irritation in individual states.

These are the taxes that hide in plain sight: on electricity bills, vehicle renewals, and phone statements.

They are not large individually, but their stealth makes them unpopular. When people can’t even spot what they are paying for, resentment builds fast.

The Emotional Undercurrent

The same survey also explored how Americans feel about debt, credit, and borrowing, and those results give context to the tax resentment.

- 54% of people say they feel stress when taking out a loan, compared to just 10% who feel relief.

- Nearly half admit that their biggest financial regret is not saving soon enough.

- Three-quarters wouldn’t co-sign a loan for a friend, reflecting how cautious and self-protective people have become about money.

It’s clear that frustration with taxes and frustration with credit stem from the same place, a desire for control in systems that often feel one-sided.

A Nation That Wants Fairness, Not Favors

Across both taxes and personal finance, a consistent theme emerges: Americans don’t mind contributing; they just want to know the system values their effort.

Whether it’s a rising property bill or a stubborn credit score, people are asking for the same thing: transparency, balance, and a sense that hard work still pays off.

Final Thoughts

Our survey results aren’t just a list of complaints; they’re a snapshot of priorities. Property taxes reflect the fear of being priced out of homeownership.

Sales taxes capture the day-to-day strain on household budgets. And the smaller, stealthier fees represent a growing frustration with complexity itself.

At its heart, this isn’t about hating taxes. It’s about wanting fairness, the simple belief that if people play by the rules, the rules should at least play fair in return.

Disclaimer:

This blog post is for informational purposes only and is not intended as financial, legal, or tax advice. The survey data referenced was collected by 5 Star Car Title Loans from over 3,000 U.S. respondents in 2025.

All opinions expressed are those of the authors and may not reflect the official views of 5 Star Car Title Loans.

Please consult a qualified professional regarding your individual financial situation. Loan terms and availability vary by state and are subject to eligibility.

![The Most Hated Taxes in the U.S. [2025] Banner](https://5starloans.com/wp-content/uploads/2025/11/Updated-Banner.png)