Complete Guide to Short-Term Personal Loans

Approximately 12 million Americans use payday loans annually, seeking quick cash to cover unexpected expenses and bridge financial gaps until their next payday. These short term instant loans provide immediate access to funds but come with extremely high costs that can trap borrowers in cycles of debt.

Understanding how payday loans work, their true costs, and available alternatives is crucial for making informed financial decisions. This comprehensive guide covers everything you need to know about payday loans, from application requirements to state regulations and better borrowing options.

What Are Payday Loans?

A payday loan is a short-term, high-cost unsecured loan typically ranging from $100 to $1,500, designed to cover unexpected expenses until your next payday. Unlike traditional personal loans that require extensive credit checks and longer approval processes, payday loans offer quick access to cash with minimal requirements.

These instant loans are available through both storefront locations and online lenders, with funds provided as cash, check, electronic deposit to your checking account, or loaded onto a prepaid debit card. The typical loan term spans 2-4 weeks, aligning with most borrowers’ pay schedules.

Payday loans serve as emergency financial solutions for people who may not qualify for traditional personal loans due to poor credit history or lack of banking relationships. However, they differ significantly from conventional borrowing options in terms of cost structure and repayment terms.

The loans are structured as single payment products, meaning borrowers receive the full loan amount upfront and must repay the entire balance plus fees on their next payday. This structure sets them apart from installment loans that allow borrowers to spread repayments across monthly payments over extended periods.

How Payday Loans Work?

The payday loan process is designed for speed and simplicity, often taking just a few minutes to complete an application and receive loan approval. Many lenders also offer same day funding to ensure borrowers get quick access to cash. Many borrowers prefer online loans for their convenience and speed.

Whether applying at a storefront or through online loans platform, here’s how the typical process works:

- Application Process: Borrowers visit a storefront location or apply through an online loan platform. The loan application requires basic information including proof of income, bank account details, and valid identification. Many lenders complete this process in under 30 minutes, especially when you apply for payday loans online.

- Approval and Funding: Once approved, borrowers receive their loan proceeds either immediately (cash at storefront locations) or through electronic transfer to their bank account. Some online lenders offer same day funding, while others may take one business day for loan funding to complete.

- Repayment Authorization: Borrowers provide either a post-dated check for the full repayment amount or electronically sign authorization for the lender to withdraw funds from their checking account or savings account on the due date.

- Single Payment Structure: Unlike installment loans with monthly installments, payday loans require a lump sum repayment on the next payday, typically 14 days after receiving the loan amount. This repayment includes both the original loan proceeds and associated fees.

- Rollover Options: If borrowers cannot repay on the due date, many states allow loan rollovers where borrowers pay only the fee and extend the loan term. However, this practice significantly increases the total cost and debt burden.

Payday Loan Costs and Fees

Payday loan costs are significantly higher than other borrowing options, with fees typically ranging from $10 to $30 per $100 borrowed. Understanding these costs is crucial for making informed borrowing decisions.

- Standard Fee Structure: Most payday lenders charge $15 to $20 per $100 borrowed for a standard two-week term. This seemingly modest fee translates to an extremely high annual percentage rate when annualized.

- APR Calculations: A typical $15 fee per $100 borrowed equals a 391% APR for a 14-day loan term. By comparison, credit cards typically carry APRs between 12% and 30%, while personal loans from banks or credit unions range from 6% to 36%.

- Additional Fees: Beyond the basic borrowing fee, payday lenders may charge:

- Rollover fees when extending loan terms

- Late payment penalties for missed payments

- Insufficient funds fees when automatic withdrawals fail

- Processing fees for different payment methods

Example Cost Calculations

To illustrate the true cost of payday loans, consider these scenarios:

| Loan Amount | Fee | Total Repayment | APR (14-day term) |

| $100 | $15 | $115 | 391% |

| $300 | $45 | $345 | 391% |

| $500 | $75 | $575 | 391% |

Rollover Cost Impact: If a borrower cannot repay a $300 loan and rolls it over twice, the total cost becomes:

- Original fee: $45

- First rollover: $45

- Second rollover: $45

- Total fees: $135 for a $300 loan

These calculations demonstrate why consumer advocates and financial experts warn about the debt trap potential of payday loans.

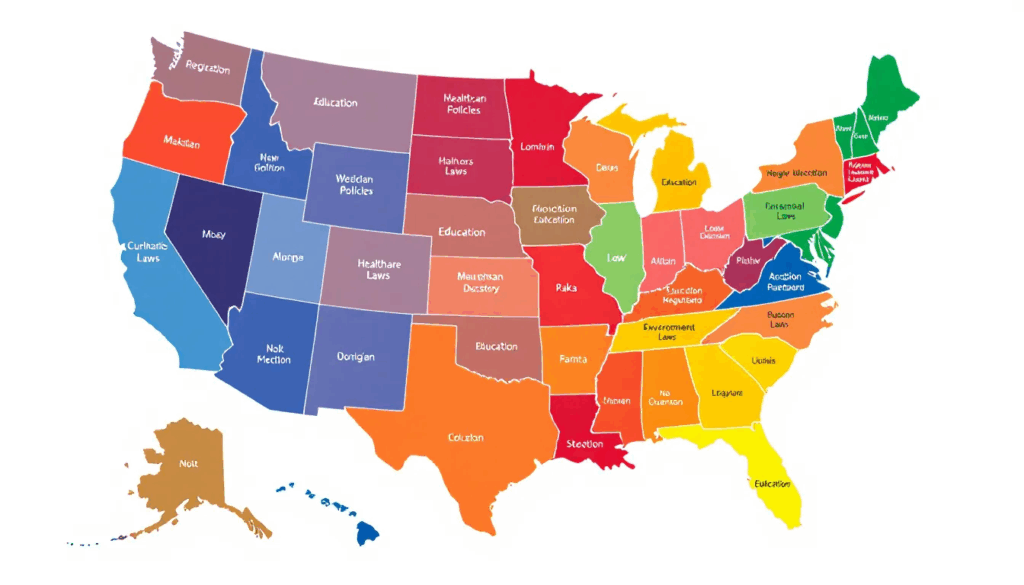

State Regulations and Legal Status

Payday loan regulations vary dramatically across states, creating a complex patchwork of laws governing these products. Understanding your state’s rules is essential before considering a payday loan.

- Prohibited States: Several states have effectively banned payday loans through strict interest rate caps:

- Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, Montana, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, South Dakota, Vermont, West Virginia, and the District of Columbia

- These states typically maintain usury laws capping interest rates at 36% APR or lower, making traditional payday lending unprofitable.

- Regulated States: Other states allow payday loans but impose various restrictions:

- Maximum loan amounts ranging from $300 to $1,500

- Limits on loan terms (typically 14-31 days)

- Cooling-off periods between loans

- Database requirements to prevent borrowers from obtaining multiple loans simultaneously

- Disclosure requirements for fees and terms

- Permissive States: Some states maintain relatively few restrictions on payday lending, allowing lenders more flexibility in loan amounts, fees, and terms.

Maximum Loan Amounts by State

States that permit payday loans often set maximum amounts:

- California: $300

- Florida: $500

- Illinois: $1,000 or 25% of gross monthly income

- Texas: $1,800

- Ohio: $1,000

These limits aim to prevent borrowers from taking on unsustainable debt levels while still allowing access to emergency funds.

Military Lending Act Protections

The Military Lending Act provides special protections for active-duty service members and their dependents, recognizing the unique financial vulnerabilities faced by military personnel.

- 36% APR Cap: The act caps the annual percentage rate at 36% for loans to covered military personnel, effectively prohibiting traditional payday loans for this population.

- Prohibited Practices: Lenders cannot:

- Require loan proceeds to be received via check cashing, debit card, or prepaid card

- Conduct transactions through military allotments

- Require waivers of consumer protection rights

- Require mandatory arbitration clauses

- Require unreasonable notice of default or acceleration

- Required Disclosures: Lenders must provide clear information about:

- The annual percentage rate and payment terms

- Rights under the Military Lending Act

- Contact information for military financial counselors

- Resources for Service Members: Military personnel have access to:

- Judge Advocate General (JAG) legal assistance

- Military Family Life Counselors

- Financial counseling through Military Family Financial Services

- Emergency financial assistance programs

- Penalties for Violations: Lenders who violate Military Lending Act provisions face significant penalties, including fines and potential criminal charges for knowing violations.

Pros and Cons of Payday Loans

Understanding both advantages and disadvantages helps borrowers make informed decisions about whether same day payday loans are appropriate for their situations.

Advantages

- Quick Access to Cash: Payday loans provide rapid access to funds, often within hours of application. This speed can be crucial during genuine financial emergencies.

- Minimal Credit Requirements: Unlike traditional personal loans or unsecured personal loan products, payday lenders typically don’t require excellent credit or extensive credit report reviews. Borrowers with poor credit history can often qualify.

- Simple Application Process: The application takes just a few minutes and requires minimal documentation compared to conventional loan products.

- No Collateral Required: As unsecured loans, payday loans don’t require borrowers to risk personal assets like homes or vehicles.

Disadvantages

- Extremely High Costs: The 391% average APR makes payday loans among the most expensive borrowing options available, far exceeding credit cards or traditional loans.

- Short Repayment Terms: The requirement for lump sum repayment within 14 days creates financial strain for many borrowers who may not have improved their cash flow situation.

- Debt Trap Potential: Nearly 80% of payday loans are rolled over or renewed within two weeks, creating cycles where borrowers pay more in fees than they originally borrowed.

- Limited Loan Amounts: Maximum loan amount restrictions may not adequately address larger financial emergencies.

- Negative Credit Impact: While payday lenders typically don’t report to credit bureaus for successful repayments, defaulted loans can damage credit scores.

Alternatives to Payday Loans

Before considering a payday loan, explore these typically less expensive alternatives that can provide access to emergency funds.

Traditional Financial Institution Options

- Personal Loans from Banks and Credit Unions: These institutions offer unsecured personal loan options with much lower interest rates, typically ranging from 6% to 36% APR. While approval may take longer than payday loans, the cost savings are substantial.

These personal loans are often used for debt consolidation, helping borrowers combine multiple debts into a single loan with a fixed interest rate and manageable monthly payments. - Credit Card Cash Advances: Although expensive, credit card cash advances typically cost less than payday loans, with APRs ranging from 25% to 30%. Many credit unions offer special cash advance loan programs with even lower rates.

- Overdraft Protection: While bank account overdraft fees are costly (typically $35 per transaction), they may be less expensive than payday loan fees for small amounts.

Better Short-Term Loan Options

- Credit Union Payday Alternative Loans (PALs): Federal credit unions offer PALs with APRs capped at 28%, loan amounts up to $1,000, and repayment terms of 1-6 months. These installment loans provide the same quick access to cash with significantly lower costs.

- Online Installment Loans: Various online lenders offer small-dollar installment loans with APRs typically ranging from 36% to 199%, still high but considerably less than payday loans. These online loans allow borrowers to make monthly payments rather than single payment repayment.

Many lenders offer online loans for bad credit, providing access to funds with more manageable terms than payday loans. - Employer Payroll Advances: Many employers offer payroll advance programs allowing workers to access earned wages before payday. These programs typically charge minimal fees or no fees at all.

- Earned Wage Access Apps: Different companies provide access to earned wages for small fees, typically $1-5 per transaction, making them far less expensive than payday loans.

Community and Family Resources

- Emergency Assistance Programs: Local nonprofits, religious organizations, and government agencies often provide emergency financial assistance for utilities, rent, or medical expenses.

- Family and Friends: While potentially awkward, borrowing from family or friends typically involves no interest charges and flexible repayment terms.

- Community Development Financial Institutions (CDFIs): These organizations focus on serving underbanked communities and often offer small-dollar loans with reasonable terms.

How to Apply for an Online Payday Loan

If you’ve exhausted alternatives and decide a payday loan is necessary, understanding the application process helps ensure you’re prepared and can make informed decisions. Payday loans online provide convenience and fast approval, allowing borrowers to quickly access funds without visiting a storefront.

Required Documentation for Payday Loans

- Valid Government-Issued Identification: Bring a driver’s license, state ID, or passport to verify your identity and age (must be 18 or 21 depending on state law).

- Proof of Income: Provide recent pay stubs, benefit statements, or bank statements showing regular income from employment, Social Security, or other sources.

- Bank Account Information: You’ll need account details for your checking account, including routing and account numbers. Some lenders accept savings account information.

- Contact Information: Provide current address, phone number, and employment information for verification purposes.

Online Loan Application Process

- Choose a Reputable Lender: Research online lenders carefully, checking for proper state licensing and reading customer reviews. Avoid lenders that guarantee approval regardless of financial situation.

- Complete the Application: Online loans applications typically take just a few minutes and ask for basic personal, employment, and banking information.

- Review Loan Terms: Carefully examine the loan agreement, including the loan amount, fees, annual percentage rate, repayment term, and due date before you electronically sign.

- Arrange Funding: Choose how you want to receive loan proceeds – direct deposit to your bank account, prepaid debit card, or other available methods.

Storefront Loan Application Process

- Visit During Business Hours: Most storefront locations operate standard business hours, though some extend evening or weekend hours.

- Bring Required Documents: Having all necessary paperwork ready speeds the approval process.

- Review Terms Before Signing: Don’t feel pressured to sign immediately. Take time to understand all payment terms and fees.

- Understand Repayment: Clarify exactly when and how repayment will occur, whether through post-dated check or electronic withdrawal.

Payday Loan Requirements and Eligibility

Understanding eligibility requirements helps determine whether you qualify for a payday loan and what to expect during the application process.

Basic Eligibility Criteria

- Age Requirements: Borrowers must be at least 18 years old in most states, though some states require borrowers to be 21. This varies depending on state law and individual lender policies.

- Income Requirements: Lenders require proof of steady income, whether from employment, Social Security, disability benefits, or other regular sources. The income doesn’t need to be substantial, but it must be verifiable and recurring.

- Bank Account Requirements: An active checking account in good standing is typically required. Some lenders accept savings accounts, but checking accounts are preferred for electronic payment processing.

- Residency Requirements: Borrowers must be residents of the state where they’re applying for the loan. Online lenders verify this through provided addresses and identification.

Additional Considerations

- Credit History: While payday lenders don’t typically require excellent credit or perform traditional credit checks, they may review credit reports for verification purposes rather than approval decisions. Online loans for bad credit may be an option for borrowers who have poor credit but need quick funding.

- Existing Debt: Some states require lenders to check databases to ensure borrowers don’t have outstanding payday loans with other lenders, preventing multiple simultaneous loans.

- Income-to-Debt Ratios: Although not as strictly evaluated as traditional loans, lenders may consider your ability to repay based on income and existing obligations.

- Previous Loan History: Borrowers who have defaulted on previous payday loans may face difficulty obtaining new loans, depending on the lender’s policies and state regulations.

Avoiding Payday Loan Debt Traps

The structure of payday loans creates significant risk for debt cycles. Understanding these risks and implementing protective strategies can help borrowers avoid financial harm.

Understanding Total Costs

- Calculate True Costs: Before borrowing, calculate the total cost including all fees and potential rollover charges. Consider whether the expense you’re covering is worth these costs.

- Compare with Alternatives: Always compare payday loan costs with other options like credit card cash advances loans, personal loans, or borrowing from family.

- Consider Income Impact: Evaluate whether removing the loan amount plus fees from your next paycheck will create additional financial stress.

Developing a Repayment Plan

- Budget for Repayment: Before taking a payday loan, create a realistic budget showing how you’ll repay the full amount on the due date without needing to roll over the loan.

- Identify Additional Income: Consider temporary income sources like selling items, picking up extra work shifts, or requesting overtime to help cover repayment.

- Plan for Reduced Expenses: Identify areas where you can cut spending during the loan term to ensure repayment funds are available.

Building Financial Resilience

- Start an Emergency Fund: Even saving $25-50 per month can help build a cushion for unexpected expenses, reducing future reliance on high-cost borrowing.

- Explore Financial Counseling: Nonprofit credit counseling agencies offer free advice on budgeting, debt management, and building emergency savings.

- Investigate Employer Benefits: Some employers offer emergency assistance programs, earned wage access, or low-cost loans for employees facing financial difficulties.

- Build Credit History: Working to improve your credit profile opens access to lower-cost borrowing options for future needs.

Red Flags to Avoid

- Lenders Guaranteeing Approval: Legitimate lenders always verify income and ability to repay. Avoid lenders promising guaranteed approval regardless of financial situation.

- Upfront Fees: Never pay application fees or other charges before receiving loan proceeds. Legitimate payday lenders deduct fees from the loan amount.

- Pressure Tactics: Avoid lenders who pressure you to borrow more than needed or push additional products like insurance or extended payment plans.

- Unlicensed Lenders: Verify that any lender you consider is properly licensed in your state. Unlicensed lenders may engage in illegal collection practices.

Summary and Caution on Payday Loans

Payday loans are one of the most expensive forms of consumer credit, often carrying APRs over 300%. While they can provide same day cash during emergencies, their high costs and short repayment terms can quickly lead to cycles of debt.

Roughly 12 million Americans use payday loans each year, with many paying more in fees than they originally borrowed. Regulations vary by state, with some banning payday lending and others allowing it with strict limitations.

Before turning to a payday loan, explore lower-cost alternatives such as credit union payday alternative loans, earned wage access programs, credit card cash advances, or emergency assistance options. These may provide more manageable terms and reduce financial stress.

If a payday loan is your chosen option, fully understand the costs, plan your repayment carefully, and avoid rollovers that increase your debt. Strengthening your budget and credit profile can help reduce future reliance on high-cost loans.

5 Star Loans offers payday loan services with clear terms and no hidden fees. Start your payday loan request today and see your options with no obligation.