These days, the internet is a platform where almost everything can be searched or done and title loans are no exception. With 5 Star Car Title Loans you can apply online for a loan and save yourself a visit to the store.

Title Loans Completely Online with No Store Visit

We know that getting to the store may not always be ideal, so we created an application and loan process that can be completed online or via a mobile phone. There is no need to visit any branch, saving you valuable time and money.

You can receive your money from the comfort of your home- either through a direct deposit or MoneyGram. MoneyGram is a safe and quick option that allows you to get cash in many locations, including your local WalMart.

So how do we make our online title loans with no store visit work? Continue reading to get all the information.

We’ve created an efficient process that allows you to be approved quickly with a fast application process and money in your hands shortly after that

No Store Visit – Apply Online!We Have 2 Ways to Apply Online:

Simply fill out our online application and receive an instant call from one of our representatives who will explain your loan options.

Option 2 – 100% Online

Complete the entire loan process online: fill out the application, get approved, electronically sign your loan documents and finally receive your funds with our leading online title loan platform.

Apply online in 4 Easy Steps:

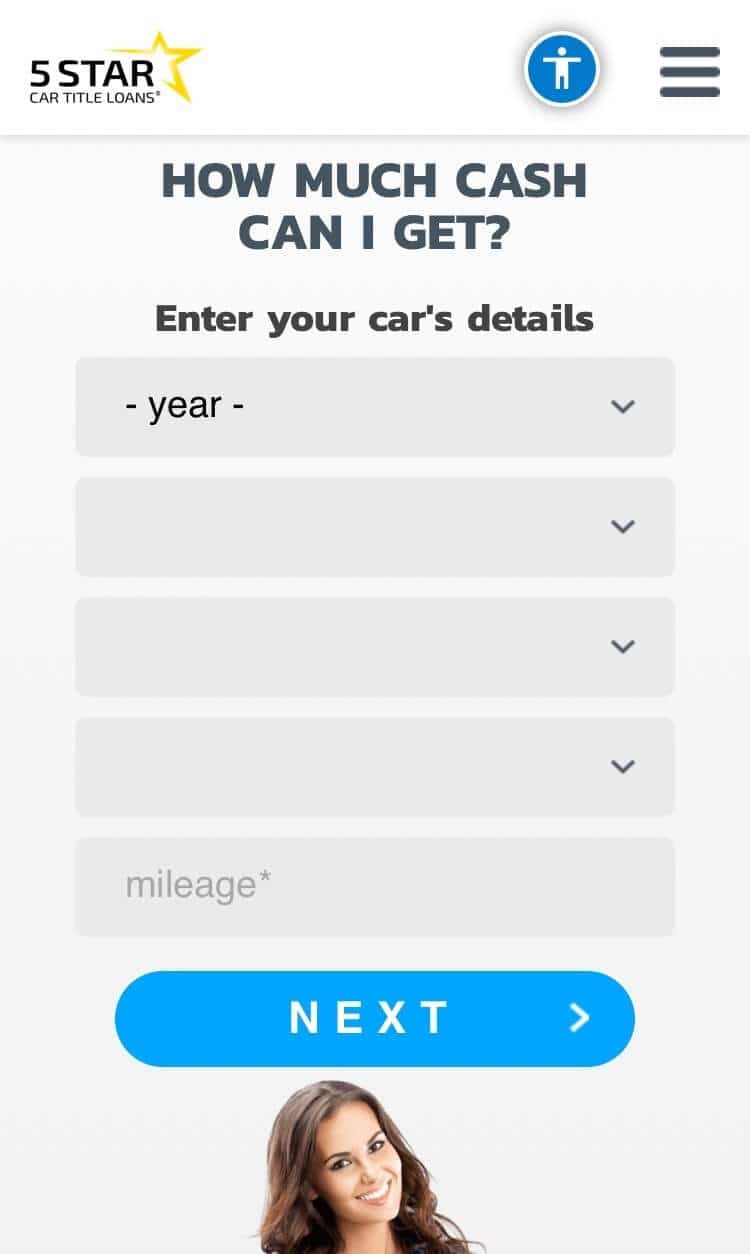

Step 1

Enter Your Car’s Details:

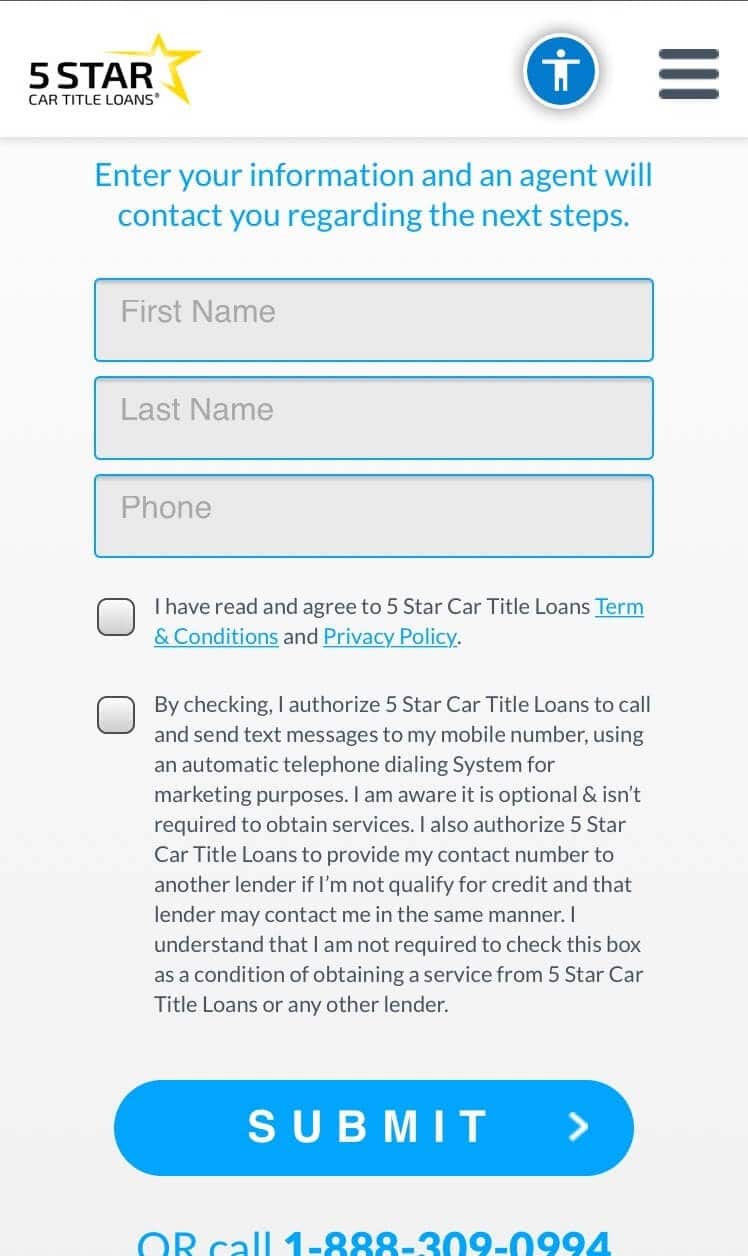

Step 2

Your Personal Information:

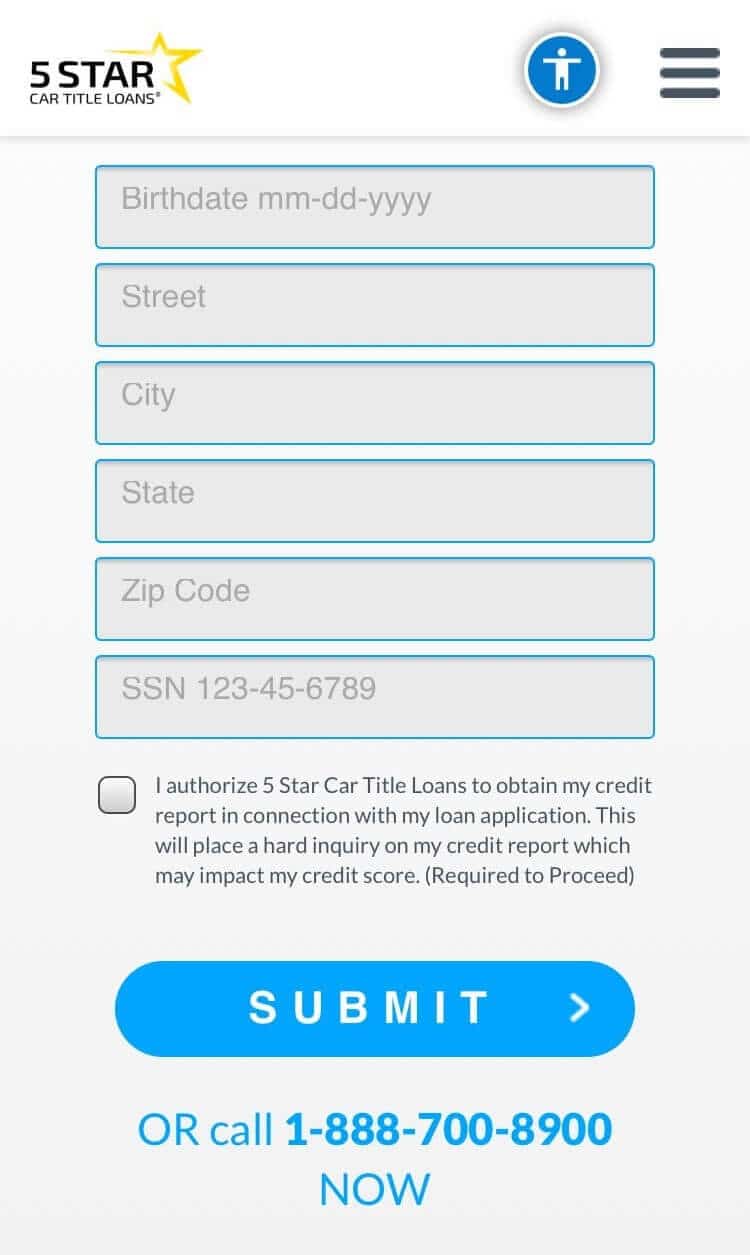

Step 3

Address, Date of Birth and SSN:

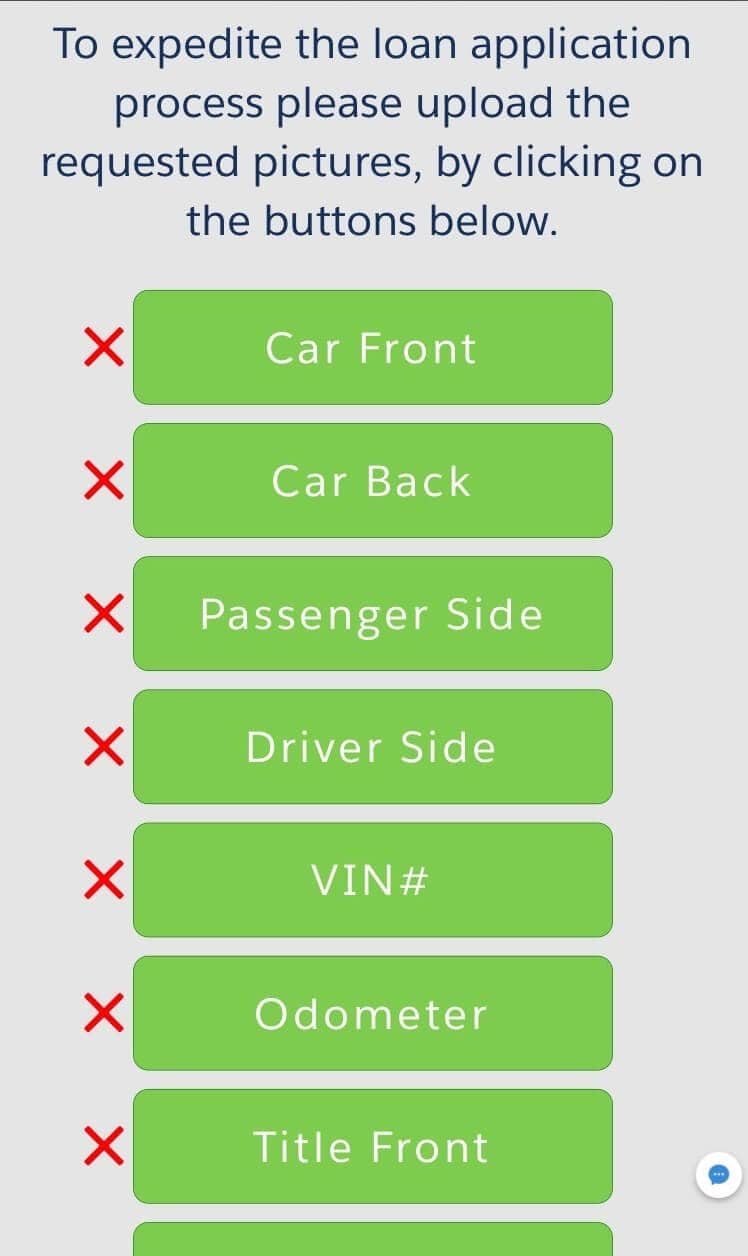

Step 4

Upload Photos of Your Vehicle:

The first step is to submit your basic details which will help us verify your loan eligibility:

Step 1: Submit basic details

- Your name

- Phone number

- Vehicle information

- Address

- Date of birth

- Social Security Number

Step 2: Complete your application

Once we confirm you are pre-approved for a loan, you will be asked to complete your application by submitting a few final documents.

Upload:

- Photos of your vehicle

- A copy of your Driver license

- A copy of your Car title

Step 3: Loan offer

Receive your loan offer:

Once we have your completed application with all of the information mentioned above, one of our loan experts will contact you to provide you with a loan offer and explain the terms you qualify for.

Our loan representatives can answer any question and explain any detail you may wonder about.

Step 4: Get the money!

The final step is to get your money!

Finally*, we will provide you with a shipping label, free of charge, so you can send your car title to us. You will be asked to drop off your car title at any FedEx location and once we confirm the title was sent, the funds will be transferred to you.

*There are certain cases in which the borrower will be asked to visit one of our GPS Centers for an installation of a tracking device onto the vehicle, completely free of charge.

People choose online title loans because they are simple and quick! It only takes a few minutes to fill out the application, after which you get approved and submit all necessary documents to start your loan process and get your funds

Get Online Title Loans with No Store Visit – Apply Online!What Do I Need To Apply?

Ready to get your loan started without visiting any store?

The following is a list of items you will need to provide in order to get your application started:

- Clear Vehicle Title

- Photo ID

- Insurance & Registration

- Income Information

- Access to Vehicle for Photos

How Do You Get a Car Inspected If You Don’t Visit a Title Loan Store?

We don’t require that you bring in your car, simply send us some photos so we can see it is in good condition!

When you apply for a loan with 5 Star Car Title Loans, you will be asked to send us several photos of your car. We require several photos of the vehicle exterior, interior, VIN, and odometer. You can simply take these photos with your mobile device and upload them to our title loan app or text them to us.

We use these photos to confirm the details in the documentation provided, determine the value of the vehicle, and qualify you for the auto title loan. Instead of a vehicle inspection which can be both costly and time-consuming, simply snap a few photos and let us do the rest!

There are no obligations in applying for a title loan and checking if you qualify! All you need to do is complete the online form on our website and one of our loan experts will be in contact with you shortly after!

The Advantages of an Online Car Title Loan

- No need to drive to a title loan store

When you choose to apply online with 5 Star Car Title Loans, you are taking a big step toward getting the title loan you need without any hassles. You avoid the need to drive to the loan store and finish the entire process from the comfort of your home on your own schedule.

- Fast and easy

Online title loans allow you to get the money you need in an extremely efficient process. Assuming there are no special issues, you can access cash within hours of being approved!

- You keep your vehicle

Many people think that they will need to surrender their car to the title loan lender for the duration of the loan. Fortunately, this is not true! You get to continue driving your vehicle while repaying back the loan.

- Great alternative to other loans

When compared with payday loans for example, car title loans often offer better interest rates and terms. Because your vehicle is used as collateral for the loan, it allows the lender to charge lower rates and get you a better loan!

- Convenient repayment plans

At 5 Star Car Title Loans, we don’t charge early prepayment penalties. This allows you to pay off your loan earlier than the loan’s maturity date, saving you money and helping you get back on your feet financially.

- Suitable loans for customers with bad credit

We don’t turn away customers based solely on their credit scores or history. We look at numerous factors, such as your ability to repay and your vehicle’s value, to determine your loan qualification. This enables those with bad credit to apply and get the cash they need.

- No Store Visits Needed Here!

The top reason to choose online title loans is the fact that you save time and money by completing everything from the comfort of your home. You don’t need to drive to a loan office and wait while your loan is processed. With us there is no need to take time off work or waste any precious moment with your family in order to apply for funds!

Getting started is simple. Fill out the required information in our online application and sit back while we process all the details. This is a quick process so be ready for a phone call from one of our representatives!

If you’re not sure whether you qualify for a car title loan, give us a call. Our specialists are waiting by to help each and every customer with their own unique situation. We will walk you through every step so you can rest assured you’re in good hands

More Advantages of Online Title Loans with No Store Visits

Time-saving convenience

Time is a valuable commodity, and online title loans help you save it. With an easy online application process and virtual car inspections, you can complete the entire loan process from the comfort of your home or office. No more store visits or waiting in line!

The entire online title loan process is designed for speed and efficiency. From submitting your application to receiving approval and funding, each step is streamlined to ensure you get the funds you need without any unnecessary delays.

Privacy and security

Your privacy and security are paramount when applying for an online title loan. Reputable online lenders ensure your personal information and documentation are securely stored and transmitted throughout the entire process. No more worrying about leaving sensitive documents at a store. With online title loans, you can confidently submit your information knowing it’s safe and secure.

Flexibility for borrowers

Online title loans offer flexibility for all types of borrowers. Bad credit? No problem! Online title loans are secured by your vehicle, making them less risky for lenders and more accessible for those with poor credit scores.

Additionally, online title loans can accommodate borrowers with unconventional income sources. So whether you’re self-employed or have a fluctuating income, online title loans offer a flexible solution to your financial needs.

How to Choose a Reputable Online Title Loan Provider

Now that you know the benefits of online title loans, it’s crucial to choose a reputable provider. But how do you find a trustworthy lender? It’s all about researching and reading reviews, comparing interest rates and fees, and evaluating customer service. By following these steps, you can ensure you’re working with a reliable online title loan provider who has your best interests in mind. Let’s delve into each aspect to consider when selecting a lender.

Research and reviews

Research is essential when selecting an online title loan provider. Start by reading reviews from past customers to gain insight into their experiences with the lender. Pay attention to how the lender handled any issues or concerns, as this can give you a good idea of their trustworthiness.

Additionally, investigate the lender’s background, licensing, and any complaints or legal issues they may have faced. This information will help you make an informed decision when choosing a reputable online title loan provider.

Interest rates and fees

Interest rates and fees are a crucial factor to consider when selecting an online title loan provider. Comparing rates and fees between lenders will ensure you’re getting a fair and competitive deal. Keep in mind that the average APR for title loans is around 300%, but some online title loans may have lower interest rates starting from 5.99% and going up to 35.99%.

Don’t forget to look into any additional fees, such as origination fees, late fees, and prepayment penalties. A transparent lender will provide clear and straightforward information about all fees associated with the loan.

Customer service

Customer service is a critical aspect of a reputable online title loan provider. A good lender will have responsive customer service channels, such as phone, email, or live chat, to address any issues or questions promptly. You can expect assistance with the loan application, answers to any questions or concerns, and support throughout the loan period.

A lender that prioritizes customer service will ensure a smooth and positive experience from start to finish.

Tips for Managing Your Online Title Loan Responsibly

Obtaining an online title loan is just the beginning – managing it responsibly is crucial for a successful borrowing experience. To stay on track and avoid defaulting, consider creating a repayment plan, maintaining communication with your lender, and exploring refinancing options if necessary.

By following these tips, you can ensure that you’re handling your online title loan responsibly and avoiding any potential pitfalls.

Creating a repayment plan

Creating a repayment plan is essential for staying on top of your loan payments and avoiding any missed payments. Work with your lender to establish a repayment schedule that aligns with your financial situation and budget.

Remember to include any fees or additional costs in your repayment plan and consider making extra payments if possible. This will help you pay off your loan faster and save on interest.

Communicating with your lender

Maintaining open communication with your lender is vital for successfully managing your online title loan. If you encounter any issues or concerns, reach out to your lender immediately. They may be able to offer assistance, negotiate more favorable loan terms, or provide solutions to any problems.

By keeping the lines of communication open, you can ensure a positive borrowing experience and avoid any potential issues that may arise during the loan period.

Refinancing options

If you’re struggling to make your loan payments, refinancing options may be available to help. Refinancing can lower your interest rate or extend your loan term, making it easier to manage your monthly payments.

Before considering refinancing, communicate with your lender to discuss your situation and explore any potential solutions. They may be able to offer guidance or alternative options to help you manage your online title loan responsibly.

Frequently Asked Questions

What is a title loan on a car?

A car title loan is a type of short-term loan in which the borrower pledges their car as collateral. To get this loan, the borrower must own their car free and clear and may receive up to 50% of its value in exchange for giving the lender the title.

This loan typically comes with repayment periods of 15 to 30 days and high costs.

Can i get a title loan without bringing in my car?

You can apply for online title loans without having to show your car – just submit your photo ID, pay stubs, and other documents to prove your income.

This makes it easier and more convenient to get the money you need without having to leave your home.

What is an online title loan?

An online title loan is a secured loan where you give up your vehicle’s title in exchange for quick financing, all done online.

How does the virtual car inspection work?

Virtual car inspection is a convenient way to determine the value of your car – simply submit some pictures, VIN and odometer reading and the lender takes care of the rest!

No need to take your car to a mechanic or wait in line at the DMV. With virtual car inspection, you can get an accurate assessment of your car’s value in a matter of minutes.

The process is simple and secure. All you need is an internet connection.

Can I get an online title loan with bad credit?

Yes, you can get an online title loan with bad credit as they are secured by your vehicle.

These loans are a great option for those who need quick cash but have bad credit. They are easy to apply for and can be approved quickly. The loan amount is based on the value of the loan.

Get A Free Online Title Loan Quote

Want to know how much money you qualify for? That’s the easiest part! Simply complete the from on our website and one of our representatives will be in touch with you after reviewing your application. Once approved, they will explain the rest of the process and how you can get the funds you need.

While talking to our loan specialists, we recommend asking any question and raising every concern. Each specialist will be able to help you understand your loan terms and what you are agreeing to. Taking on a loan is an important decision and we emphasize the importance of checking all options and understanding all details. Our specialists are gladly waiting by to discuss the loan process with you!

No need to go outside for a title loan! Get an instant online title loan with no store visit! Give us a call and get the cash you need FAST!