- Choose a loan amount

- Fill in loan term

(1-36 months) - Fill in interest rates

| Payment Date | Payment | Principal | Interest | Total Interest | Balance |

|---|---|---|---|---|---|

| Mar 2026 | $510.37 | $491.62 | $18.75 | $18.75 | $4,508.38 |

| Apr 2026 | $510.37 | $493.46 | $16.91 | $35.66 | $4,014.92 |

| May 2026 | $510.37 | $495.31 | $15.06 | $50.71 | $3,519.60 |

| Jun 2026 | $510.37 | $497.17 | $13.20 | $63.91 | $3,022.43 |

| Jul 2026 | $510.37 | $499.04 | $11.33 | $75.24 | $2,523.39 |

| Aug 2026 | $510.37 | $500.91 | $9.46 | $84.71 | $2,022.49 |

| Sep 2026 | $510.37 | $502.79 | $7.58 | $92.29 | $1,519.70 |

| Oct 2026 | $510.37 | $504.67 | $5.70 | $97.99 | $1,015.03 |

| Nov 2026 | $510.37 | $506.56 | $3.81 | $101.80 | $508.46 |

| Dec 2026 | $510.37 | $508.46 | $1.91 | $103.70 | $0.00 |

The information generated by our “car title loan calculator” above is based only on details provided by you. The values generated are for informational purposes only and are not part of 5 Star Car Title Loans® application process. The actual payments, rates, and terms may vary and are in no way guaranteed or offered as part of a loan. All the calculations assume payments are made in full and on time.

Estimate Your Title Loan Costs in Seconds

Use our free Title Loan Calculator to get a clear estimate of your monthly payments, total interest, and payoff schedule before you commit to anything.

Just enter your loan amount, term length, and interest rate to instantly see what your loan could look like.

No credit check required

No impact on your credit score

No sign-up or personal info needed

Ready to compare offers? Use your results to see how 5 Star Loans® stacks up or check your eligibility now. It’s free and won’t affect your credit score.

Title Loans Are Expensive — Use Our Free Calculator

A title loan calculator shows how much you’ll pay each month if approved for a certain loan term.

This is essential because:

- It helps you see if the loan fits your monthly budget.

- You can compare total costs and loan proposals from different lenders.

- It prevents surprises by showing the full repayment amount in advance.

- It helps you make confident, informed borrowing decisions.

Real-Life Example Video: See How It Works in Seconds 🎥

Here is a real-life example video showing exactly how to use our Title Loan Calculator step by step in under a minute.

The video below walks you through entering your loan details and reviewing estimated payments step by step.

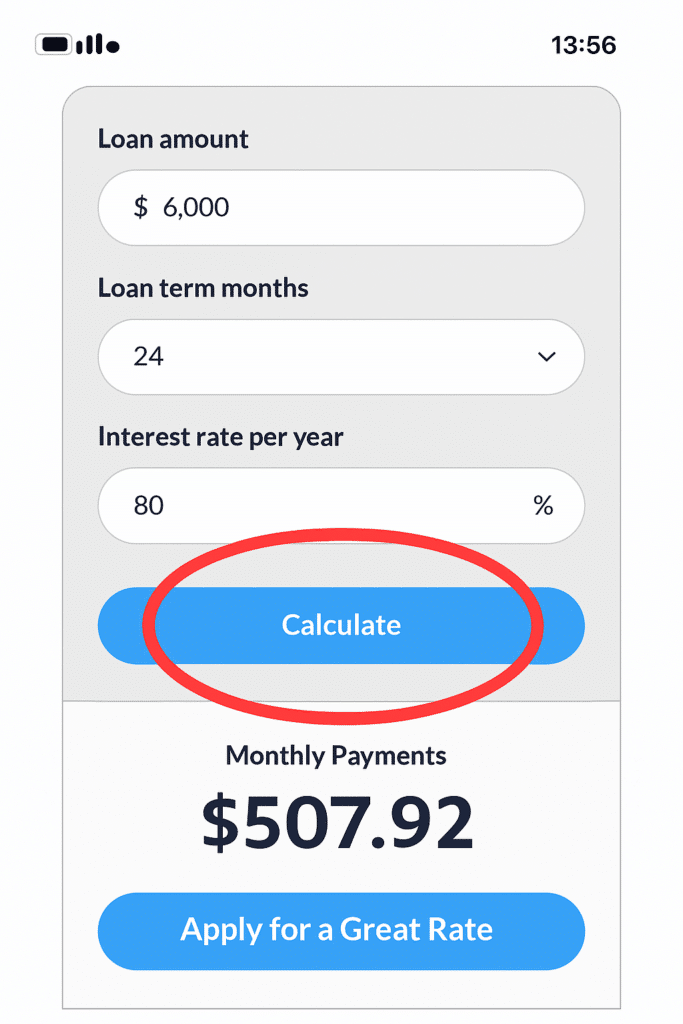

- Enter your loan amount, loan term months, and interest rate

- Instantly view your estimated monthly payment

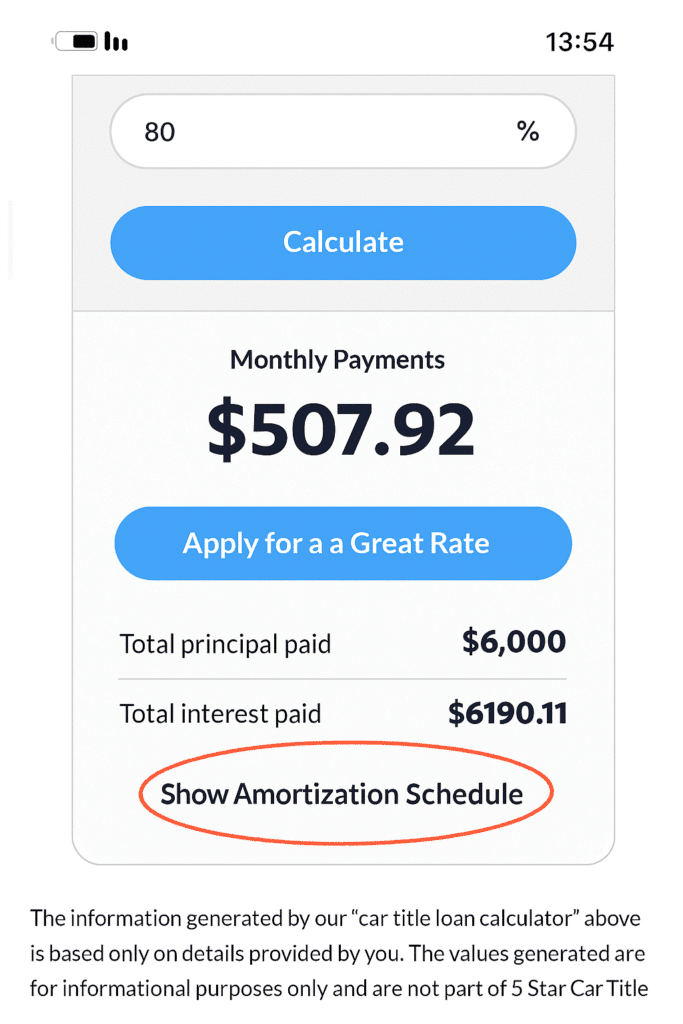

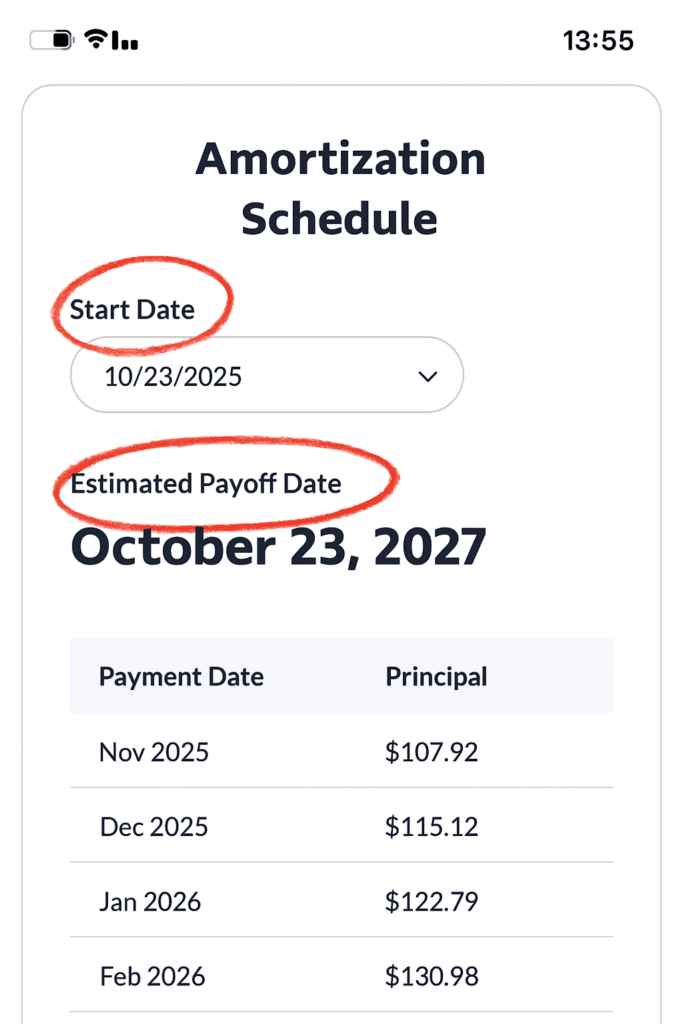

- Check the total principal, interest, and full amortization schedule including your payoff date

No more guessing what your loan will cost!

You can see every key detail, from total interest to your final payment month.

Example of a Typical Title Loan Calculation

Below is a real-world example* using the same data from our “How to Use Our Title Loan Calculator and Get Results in Seconds” video.

This example* demonstrates how a borrower may qualify and what repayment details look like using our calculator.

Real-World Title Loan Calculation Results

| Example Details | Borrower Profile & Loan Information |

|---|---|

| Vehicle | 2016 Toyota Camry (valued at ≈ $10,000) |

| Borrower’s Monthly Income | $1,580 |

| Debt-to-Income (DTI) Ratio | 35% |

| Credit Score | 590 |

| Approved Loan Amount | $6,000 (≈ 60% of vehicle’s value) |

| Loan Term | 24 months |

| APR (Interest Rate) | 80% |

| Monthly Payment (Estimated) | ≈ $508 |

| Total Principal Paid | $6,000 |

| Total Interest Paid (Est.) | ≈ $6,191 |

| Total of Payments | ≈ $12,191 |

| Estimated Payoff Date | 24 months from funding date |

*This example is for illustration purposes only. The figures shown apply to this specific scenario and do not represent an actual offer. Loan approval and terms depend on multiple factors, including vehicle value, income, credit history, and state regulations. Results may vary for other borrowers.

Download the Full Example Amortization Schedule (PDF)

Want to see how the full repayment schedule looks over time?

Click here to download the complete amortization schedule example (PDF)

Explanation

In this example, the borrower’s vehicle value, income, and DTI (DTI Shows how much of your income goes toward debt payments. Lenders use it to check if you can afford a new title loan). show sufficient repayment capacity.

A 2016 Toyota Camry valued at $10,000 allows borrowing roughly 60% of its equity, resulting in a $6,000 loan.

With an 80% APR over 24 months, the estimated monthly payment is around $508. Paying early can significantly reduce the total interest cost and shorten the repayment period.

Early Payoff Example (After 6 Months)

Maria, a single mom from Arizona, borrowed $6,000 using her 2016 Camry as collateral.

After making monthly payments for six months, she got a tax refund and used it to finish paying off her loan early with no extra fees or penalties.

This reduced her total interest to about $1,900 and helped her save over $4,000 compared to paying the loan over the full 24-month term.

| Detail | Full Term Payment | Early Payoff (After 6 Months) |

|---|---|---|

| Loan Amount | $6,000 | $6,000 |

| Loan Term | 24 months | 6 months |

| Total Interest Paid | $5,900 | $1,900 |

| Total Cost (Principal + Interest) | $11,900 | $7,900 |

| Savings Compared to Full Term | — | $4,000 saved |

Try Our Title Loan Calculator Now!

Now that you’ve seen a real-life example, give it a try yourself. Use our calculator to explore loan amounts, terms, and interest rate options available from 5 Star Loans® for qualified borrowers.

Enter Your Loan Amount

Think about how much money you really need. Most lenders and we offer up to $50,000.

Choose Your Loan Term

Choose a term that fits your budget (1–36 months). We offer flexible repayment options up to 36 months.

Add Your Interest Rate (APR)

Enter your estimated rate. Some lenders charge up to 300%, while our typical range is 60% to 150%.

Calculate Your Loan and See Payments, Start Date and Payoff Date

Step

4

Click “Calculate” to See Your Monthly Payment.

Step

5

Click “Show Amortization Schedule” to view full loan details.

Step

6

See your complete schedule with “Start Date” and “Payoff Date“.

Reminder: Results Are Estimates Only

The results presented in the title loan calculator are meant to help you make an informed decision about a loan. There is absolutely no limit on the number of times you can use our simple loan calculator so feel free to play around with the details and get a sense of what a loan can potentially look like.

Loan calculators are helpful tools to estimate your payments, but remember that rates, fees, and loan terms can vary depending on your state and lender.

Before signing a loan agreement, take a few minutes to read the terms carefully so you know exactly what you’re agreeing to. If you have any questions or concerns, don’t hesitate to ask your lender.

For more details about how title loans work and what to watch for, visit the FTC’s guide on payday and car title loans.

Should You Check Your Car’s Value Before Applying?

The short answer is not necessarily.

While your car’s value helps estimate equity (what your car is worth minus what you still owe), it’s not the most important factor in getting approved or deciding how much you can borrow.

What really matters is your ability to repay the loan. This means having a reliable source of income that shows you can comfortably afford the monthly payments.

According to the Federal Trade Commission (FTC), most title loan lenders approve between 25% and 50% of a vehicle’s market value.

At 5 Star Car Title Loans®, qualified borrowers may receive up to 70% based on income and repayment capacity. This flexibility comes from focusing more on your financial situation than just your vehicle’s price

Where to Check Your Car’s Market Value?

If you want to check your car’s worth or compare offers, use reliable sources like:

- Kelley Blue Book (KBB) – Provides quick estimates based on your car’s make, model, year, mileage, and condition.

- Edmunds Appraisal Tool – Offers trade-in and private sale values for a deeper understanding of market value.

These tools offer a good starting point, but remember that income, debt-to-income ratio, and repayment ability are the real factors that determine your title loan amount.

If you are unsure how much equity you have, apply online for a free equity estimate and quick pre-approval.

Get A Free Quote From Us Today!Example of How Equity Works:

Vehicle: 2017 Honda Accord Estimated Value: $10,000 Amount Owed: $3,000 Available Equity: $7,000 Possible Loan Amount (70%): $4,900 In this example, the borrower owns a 2017 Honda Accord worth about $10,000 and owes $3,000.

The available equity is $7,000, and the borrower could qualify for a loan of around $4,900 depending on income and repayment ability.

Can I Pay Off My Title Loan Early?

Yes, you can usually repay your title loan ahead of schedule. Paying early is highly recommended because it can reduce the total interest you pay over time, meaning your overall loan cost decreases significantly.

With 5 Star Car Title Loans®, there are no prepayment penalties or hidden fees. You are free to close your loan whenever it fits your budget.

If you’re looking for recommended strategies to fully get out of a title loan, check out our guide:

Ways to Get Out of a Title Loan

How to Make a Payment to 5 Star Loans?

You can pay your title loan online, by phone, in cash at Bank of America, or by mail, whichever works best for you.

For full details and step-by-step instructions, visit our How to Pay Your Loan page.

How a Title Loan Calculator Can be Useful for You

Getting as much information as you can before applying for a title loan is important and there are many advantages to using an auto title loans calculator. Here are some of the clear cut benefits:

It Is Quick And Free

You can calculate your estimated monthly payment, total interest, and payoff date in just 30 seconds. Simply enter your loan details and get a full breakdown personalized to your numbers.

Easy Comparison

Instead of working hard to compare the offers given to you by different lenders, simply enter the terms you were given and see which offer works best for you.

Optimize Your Loan

With our simple calculator and easy to understand presentation you can easily see what loan will be optimal for you. If you have any worries that you can’t afford the loan talk to your lender and see if there is any flexibility with the offer.

A title loan payment calculator can help you save time and money by giving you the insights needed to make informed borrowing decisions. It is another free tool from 5 Star Car Title Loans® to support smarter choices.

Explaining Important Title Loan Calculator Terms

Before using a title loan payment calculator, it is important to understand a few basic terms that have to do with title loans. This will help make sure you know what you are looking at and have a clear picture of how your loan can possibly look like should you choose to apply.

Loan Amount

When we are talking about the loan amount we are referring to your total loan and that includes any fees that go along with it.

For example, most title loans have a $15 fee which is charged by the DMV in order to add the lien holder on the title. Many lenders charge an administrative fee for processing the loan. The loan amount includes these fees already.

Loan Term Months

This is fairly straightforward. The loan term months are how long your loan will be for. It is common for car title loans to run anywhere between 06-48 months but this can vary by company and state.

Make sure your chosen lender doesn’t have a prepayment fee, that way you can pay off the loan in full earlier than the original length without paying anything extra.

Interest Rate

You probably already know what interest rate is but when it comes to loans it can be a bit confusing. Some companies talk about monthly interest whereas others discuss yearly interest, known as APR.

The higher the interest, the more you will pay for borrowing your loan.

The above are the main things you need to understand before using a car title loan calculator. We understand that loans can be confusing so feel free to give us a call or use the many resources we have on our website to make sure you understand it all!

Title Loan Scenarios for Different Vehicles

Our calculator works for more than cars. You can also estimate loans for:

- Motorcycles – Smaller loans, usually $1,000–$5,000, with shorter terms.

- Trucks – Higher loan amounts, since trucks often hold greater value.

- RVs – Larger collateral may allow higher loans with longer repayment terms.

- Boats – Available in some states; terms depend on local regulations.

Whatever the vehicle, the principle is the same: the more equity and stronger your proof of income, the more you may qualify to borrow.

Risks of Title Loans

While title loans offer quick access to cash, they also carry risks:

- High interest rates compared to traditional loans.

- Vehicle repossession if you default.

- Additional fees for late or missed payments.

Remember: Title loans should be used only for emergency funding. Borrow only what you need, and make sure the repayment amount fits your budget.

Frequently Asked Questions

How Much Can I Borrow?

You may qualify for up to $50,000 depending on your vehicle’s value, condition, and income. Remember that title loans can be expensive, so borrow only what you truly need.

How Accurate Is the Calculator?

Does Using the Calculator Affect My Credit?

No. This tool is free to use and does not impact your credit score.

Can I Qualify With a Bad Credit Score?

Yes. Title loans rely primarily on your ability to repay, which is shown through proof of income, as well as on your vehicle’s equity rather than your credit history.

Need More Information on How Title Loans Work?

If you’d like to learn more, explore these helpful resources:

- Learn the full process on our How Title Loans Work page.

- Watch our 1-minute video to see how the Title Loan Calculator estimates your payments.

- Download a full example amortization schedule (PDF)

- Review the Loan Requirements Guide to understand what’s needed to qualify.

- Visit our FAQs page for more answers about our services.

Still unsure? Apply online for a free estimate or call us today for more info. Our loan agents are waiting by to help you with any question or concern.