Title loans, also known as a pink slip loan, are a type of secured personal loan that uses your car title as collateral. They’re a useful option, especially if you have bad credit, as they allow you to borrow money quickly by leveraging the value of your car.4

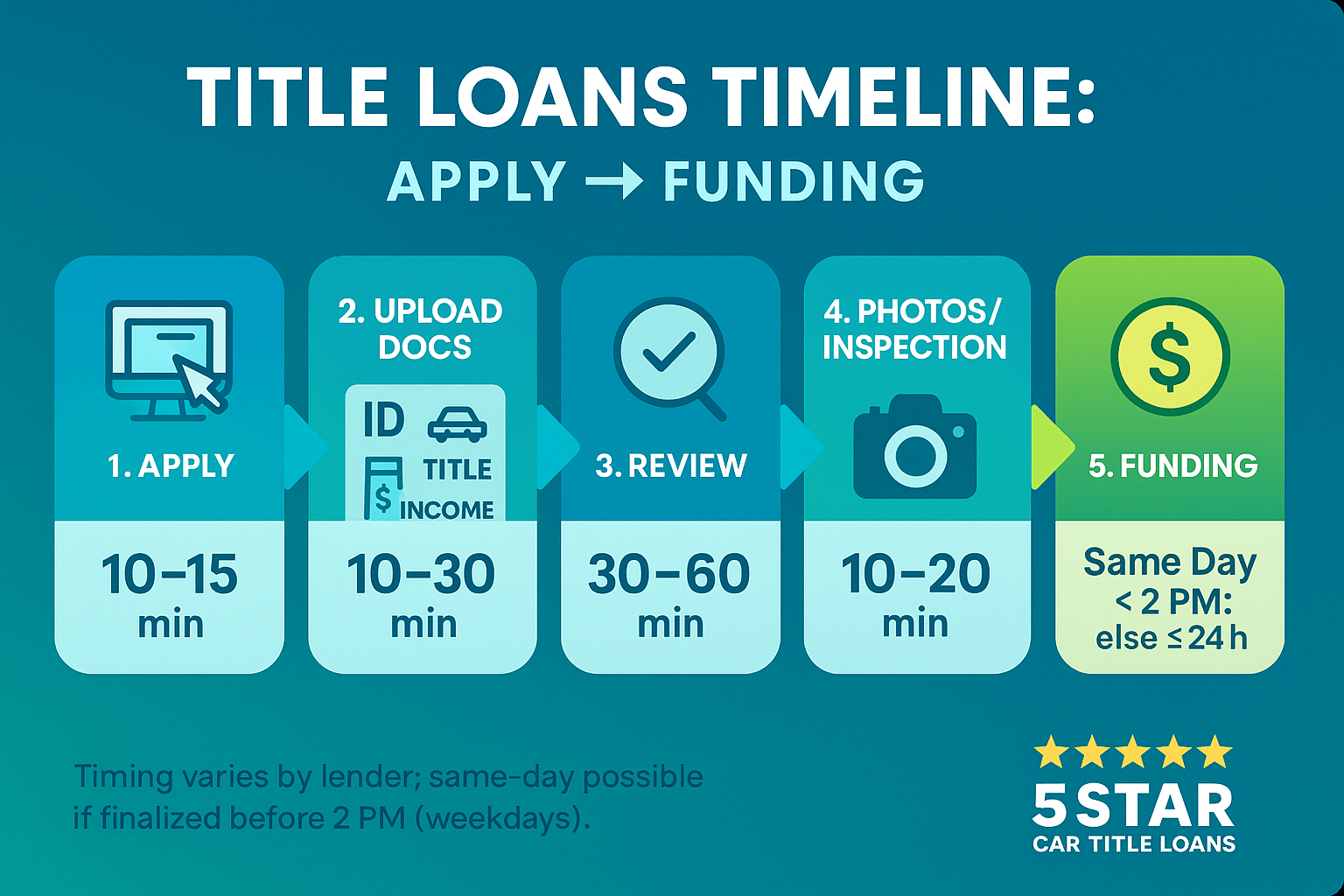

How long does it take? With complete documents, many borrowers finish the application and quick vehicle review in under an hour.

If you submit before 2 PM2 on a weekday and are fully approved, funds are often deposited the same business day. Timing can vary by lender and state rules.4

In a Nutshell

Title loans are a viable option for those needing fast access to cash, especially if you have bad credit. The process is streamlined, with decisions based on your car’s value and your repayment capability. One of the benefits of title loans is that you can continue driving your vehicle while paying off the loan, maintaining your mobility without interruption.1

Good to know:

- Purpose: Fast emergency cash using your vehicle title while you keep driving.

- Timeline: Apply 10–15 minutes, document review 30–60 minutes, photo/video inspection 10–20 minutes; funding is often the same business day if finalized before 2 PM on weekdays.

- What speeds you up: Submit clear title, ID, proof of income, proof of address, and car photos together; choose direct deposit.

- Approval factors: Vehicle equity, ability to repay, clear title, and state rules; a credit check may occur but equity and income matter more.

- Amount and terms: Based on your car’s value and state limits, commonly 25%–50% of vehicle value; rates and terms vary by state and profile.

- Trusted lender tip: Apply early, upload all docs in one go, take daylight car photos, keep your phone handy for quick verification, and double check bank details to help enable same-day funding.

Who Qualifies For a Title Loan?

If you own a car and are at least 18, you’re already on the right track1. Approval focuses more on your vehicle and your ability to repay than on a perfect credit score1.

What Lenders Look For

• Vehicle ownership in your name. Some lenders accept a small remaining balance, depending on policy.

• Age 18 or older with a valid government ID.

• Proof of income and proof of residency.

• A credit check is standard, but credit score is usually a secondary factor because the loan is secured by your car.

About the Vehicle

• The car should be in good working condition.

• Higher market value and better condition can support a larger loan amount.4

Bottom Line

Overall, car title loans are accessible to a wide range of people, especially those who may have difficulty qualifying for other types of loans such as an unsecured personal loan. Many borrowers, including those with bad credit, can qualify when the basics are met and the vehicle has solid value.

Application Process Timeline

Knowing the timeline for getting a car title loan can help you manage your expectations and financial situation effectively. Understanding the process can also help you expedite the loan approval and disbursement.

While the application process for title loans varies between title lenders, we offer a seamless application process for our customers. Our online title loan application makes it easy to apply wherever you are, whenever is convenient to you!

Initial Application Submission

To get a title loan the application process begins with submitting an application. This can be done either online or in-person at a physical location. The time to complete an application usually takes around 15 minutes.2

Documentation Requirements

To secure a title loan, you’ll need to provide specific documents. These typically include:

- Vehicle title: This must be in your name.

- Proof of income: This ensures you can pay back the car title loan.

- Proof of residency: This verifies your address.

- Government-issued ID: Such as a driver’s license or passport.

- Vehicle photos: Clear images of your car from different angles.

Gathering these documents can take time, to ensure a quick process please have them readily available.

Approval and Inspection

Once your title loan application and documents are submitted, the lender will review your information. The approval process for this type of personal loan can be as quick as 30 minutes or may take a few hours.2 Factors influencing approval speed include the completeness of your documentation and the clarity of your vehicle’s title.

After approval, a vehicle inspection may be required. This can be done in-person or remotely, we offer online inspections for the convenience of our customers. This lets you take pictures and videos of your vehicle from different angles. The time for a vehicle inspection varies but is usually relatively quick.

Fund Disbursement

Upon final approval and completion of any required inspections, the lender will disburse the loan funds. This can be done through direct deposit, check, or cash. Direct deposit to your bank account is often the fastest method, with funds available on the same day or within 24 hours. As a secured personal loan, title loans allow borrowers to keep their car while making payments.3

Factors Influencing the Timeline

Several factors can influence the overall timeline for getting a title loan:

- Documentation completeness: Providing all required documents at time of application will shorten the timeline of approval for your car title loan.

- Lender’s efficiency: Different lenders have varying processing times, we strive to get you approved fast as we understand the urgency behind car title loans.

- State regulations: Auto title loan regulations vary by state, this can sometimes impact the overall timeline.

Common Delays and Their Causes

Common delays in the auto title loan process include:

- Incomplete applications: Missing information or documents can cause delays.

- Verification issues: Difficulty verifying employment or residency can slow down the process.

- Vehicle title issues: Existing liens or unclear ownership can complicate the process.

How to Expedite the Process

To expedite the title loan process:

- Prepare in advance: Gather all required documents before applying.

- Ensure a clear vehicle title: Avoid delays by having access to the vehicle’s title.

- Choose a reputable lender: Research lenders known for quick processing times.

- Communicate effectively: Stay in touch with the lender to address any issues promptly.

Speeding to Success: Navigating the Title Loan Process

By understanding the title loan process and taking proactive steps, you can increase your chances of a quick and smooth application. Remember to carefully consider the terms and potential risks before proceeding.

Let us help you get a title loan today!4 If you have questions, we have answers. Call our customer service team or visit our FAQ page to learn more.

FAQ

What Do You Need for a Title Loan in California?

Typically, for title loans in California, you’ll need a clear vehicle title, proof of income, proof of residency, government-issued ID, and vehicle photos. However, specific requirements may vary by lender.

Who Uses Car Title Loans the Most?

People with limited access to traditional credit often turn to car title loans the most. This includes individuals with bad credit history or those facing financial emergencies. Because title loans work by leveraging the vehicle, lenders often focus more on the value of the vehicle and the borrower’s ability to repay the title loan than the borrower’s credit history.4

Do Title Loans Affect Credit?

Most auto title loan lenders do not report to credit bureaus. However, late or missed payments can negatively impact your credit score through collections or legal actions.

What Are the Typical Repayment Terms for a Title Loan?

Repayment loan terms vary by lender and are sometimes governed by state. Oftentimes car title loans are considered short-term, ranging anywhere from a few weeks to a few years. To see what your title loan terms could look like, try our title loan calculator. You can see how a title loan would work for you before applying.

Can I Apply Even If I Have an Existing Title loan?

Certainly, we offer title loan refinancing that could help you lower your payments and/or lengthen your loan terms.