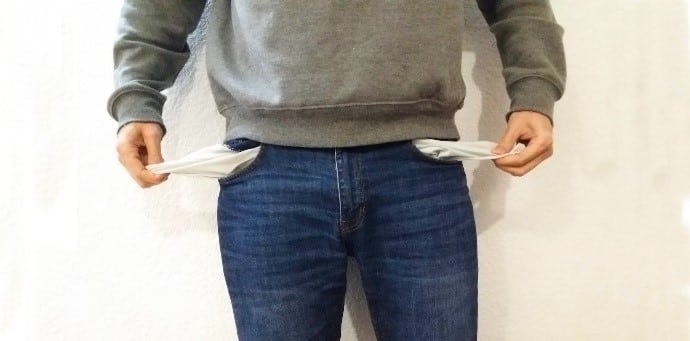

Securing a personal loan without traditional banking services can be challenging. Financial institutions often rely on traditional banking systems to assess a borrower’s creditworthiness and manage transactions. If you don’t have a bank account, you might feel locked out of access to credit.

In A Nutshell

Obtaining a loan without a personal bank account can feel impossible. While it limits your options it is still accessible. Options such as a title loan, payday loan, or pawn loans can help you in financial times of need.

Why Is It Difficult to Get a Loan Without a Bank Account?

Lenders often require a bank account to verify identity, income, and financial stability. Bank statements provide insights into an applicant’s financial habits, making it easier for lenders to assess the risk of lending. Without a traditional bank account, it’s challenging for lenders to confirm your ability to repay a loan, increasing their risk.

Bank accounts also simplify loan disbursement and repayment, allowing for seamless transfers and automatic payments. Without a checking account, borrowers must rely on less convenient methods like cash or prepaid cards, which can incur additional fees and complicate the repayment process. This lack of automation increases the risk of late payments and defaults, which can harm your credit.

Lenders perceive a borrower without traditional banking services as higher risk due to the difficulty in verifying financial stability and setting up automatic payments. As a result, they may either decline loan applications or charge higher interest rates and fees to compensate for the increased risk, making loans more costly and less accessible.

Do All Loan Lenders Require You To Have a Bank Account?

Not all lenders require bank accounts! If you are looking for a loan you do have options. These options often come with higher interest rates or require some type of collateral. These lenders often use different methods to verify identity and financial stability, such as employment verification or the use of collateral.

Is It Possible To Get a Loan With No Bank Account and Bad Credit?

If you have no bank account and bad credit, obtaining a personal loan becomes significantly more difficult. If you do find a willing lender, be prepared for higher interest rates and fees. Lenders increase these rates to mitigate the risk associated with lending to individuals who have both poor credit and no bank account.

With bad credit and no bank account, your options for personal loans are even more limited. Traditional lenders such as banks and credit unions are unlikely to approve your application, leaving you with alternative lenders. These lenders may offer you a loan, but these options often come with unfavorable terms and high costs.

One potential solution is to find a co-signer. A co-signer with good credit and a checking account can help you secure a personal loan with better terms. The co-signer agrees to take on the responsibility of repaying the loan if you are unable to do so. This arrangement reduces the lender’s risk, potentially leading to more favorable interest rates and terms.

Pros and Cons of Loans without a Bank Account

Pros

- Accessibility: Loans without traditional banking are accessible to those who might not qualify for mainstream loans, providing a financial lifeline in emergencies.

- Cash Disbursements: Borrowers can receive funds in cash or through alternative methods, which can be beneficial for those who do not use traditional banking services.

- Flexibility: Some alternative lenders offer flexible loan terms and quick approval processes, making it easier to access funds when needed.

Cons

- Higher Fees and Interest Rates: Loans from alternative lenders often come with significantly higher fees and interest compared to traditional personal loans.

- Limited Loan Amounts: Lenders may offer smaller loan amounts due to the higher perceived risk of lending to individuals without traditional banking services.

- Potential for Predatory Lending: The market for loans without a bank can include predatory lenders who prey on borrowers’ desperate situations.

What Loans Can I Get Without a Bank Account?

Don’t let the lack of a bank account get you down. You do have options!

Title Loans

Title loans allow you to borrow money by using your vehicle as collateral. If you own your car outright, you can receive a loan up to 50% of its value. The personal loan lender holds the title of your vehicle until the loan is repaid, conveniently the borrower keeps the vehicle. Title loans can be risky because failure to repay the loan may result in the loss of your vehicle. Additionally, these loans often have high interest rates and fees.4

Payday Loans

A payday loan is a short-term, high-interest loan designed to be repaid by your next payday. Payday loans are accessible to individuals without traditional banking services, as payday loans do not require extensive credit checks or bank account verification. However, payday loans often come with high fees and interest rates, which can lead to a cycle of debt if not managed carefully.

Pawn Shop Loans

Pawn shop loans are secured loans that allow you to borrow money against personal items, such as jewelry or electronics. The pawnshop assesses the value of your item and offers a loan based on a percentage of that value. If you fail to repay the loan, the pawnshop keeps the item. Pawn shop loans do not require a bank account or a credit check.

Can I Build Credit Without a Bank Account?

Credit card applications might not always ask for bank details, but if you don’t have a bank account or checking account, ensure the card provides alternative payment options. Using the card responsibly and paying on time can help you build a positive credit history, improving your chances of qualifying for future loans.

If you’re struggling to get a personal loan or unsecured credit card due to a limited or bad credit, consider a secured card or a credit-builder loan.

Here’s How They Function:

Secured Credit Cards

Secured credit cards require a cash deposit, which serves as collateral and typically determines the credit limit. These cards can help you build or improve your credit score as you use them responsibly.

Even without a bank, you can usually obtain a secured credit card by providing the required deposit via alternative payment methods. Making timely payments and keeping your balance low can positively impact your credit history.

Credit-Builder Loans

Credit-builder loans are specifically designed to help individuals build credit. Unlike traditional loans, the loan amount is held in a savings account while you make payments. Once the loan is paid off, you receive the money. This process not only helps build your credit history but also encourages saving.

Credit-builder loans are available from some credit unions and online lenders, and they often do not require an active bank account. However, be sure to research the lender’s requirements and fees before applying.

How to Open a Bank Account

One idea to open your options is opening an account. Opening a bank account is a crucial step in managing your finances and accessing a range of financial services. Whether you’re looking to manage day-to-day transactions, save for future goals, or simply establish a financial footprint, having a bank account provides convenience and security.

- Choose the Right Account: Decide between checking, savings, money market, or CD accounts based on your needs.

- Select a Bank or Credit Union: Choose a traditional bank or a credit union that suits your preferences.

- Gather Documents: Prepare your ID, Social Security Number, proof of address, and initial deposit.

- Apply: Visit a bank branch or a credit union office, or apply online. Complete the application and provide your documents.

- Review and Sign:Carefully read through all terms and conditions. Once everything is clear, sign the agreement to officially open your account.

- Set Up: Make your initial deposit and order checks if needed. Set up online banking to manage your account conveniently.

- Monitor: Regularly check your account, maintain your balance, and update your information as needed.

Navigating Loans Without a Bank Account

Obtaining a loan without traditional banking services requires careful consideration and planning. While alternative lenders can provide necessary funds, they often come with higher costs and stricter terms. It’s essential to weigh these factors and choose the best option for your financial situation.

By understanding the different types of loans available, you can make informed decisions and avoid falling into a cycle of debt.

If you don’t have a bank account and are considering a title loan, we might be able to help. Fill out our request form to see how much you can get with no obligations. If you have any questions, feel free to contact us. Additionally, you can read our blog to improve your financial literacy and plan for a more secure financial future.4

FAQ

Do You Have to Have a Bank Account for Cash Advances?

No, not all cash advances require a bank account. Some lenders offer cash advances through prepaid debit cards or in cash, making them accessible to those without a bank account. However, these options often come with high fees and interest rates.

Who Will Give Me a Loan if No One Else Will?

If traditional lenders have denied you, alternative lenders such as payday lenders, pawnshops, and auto title loan companies may offer loans. While these options provide access to funds, they often come with higher interest rates and fees. It’s crucial to read the terms carefully and understand the costs involved.

How to Borrow Money When You Have None?

When you have no money, consider secured loans, such as title loans or pawn shop loans, where you can use collateral. Alternatively, you might find a cosigner with good credit to help you secure a personal loan. Another option is to explore local community programs or nonprofit organizations that offer financial assistance or low-interest loans.

Written by

Crystal Voogd

Crystal, with a bachelor’s degree in Family and Human Services and a minor in Finance, offers a unique perspective. Specializing in personal finance, Crystal’s clear and insightful writing covers topics such as title loans, budgeting, and credit management. Dedicated to empowering readers in their financial journey, Crystal provides reliable guidance for informed decision-making and stability.